The Zerhouni rule: “Every company that acquires a platform company kills it.”

Why Medivation makes the perfect biotech takeover target for Sanofi

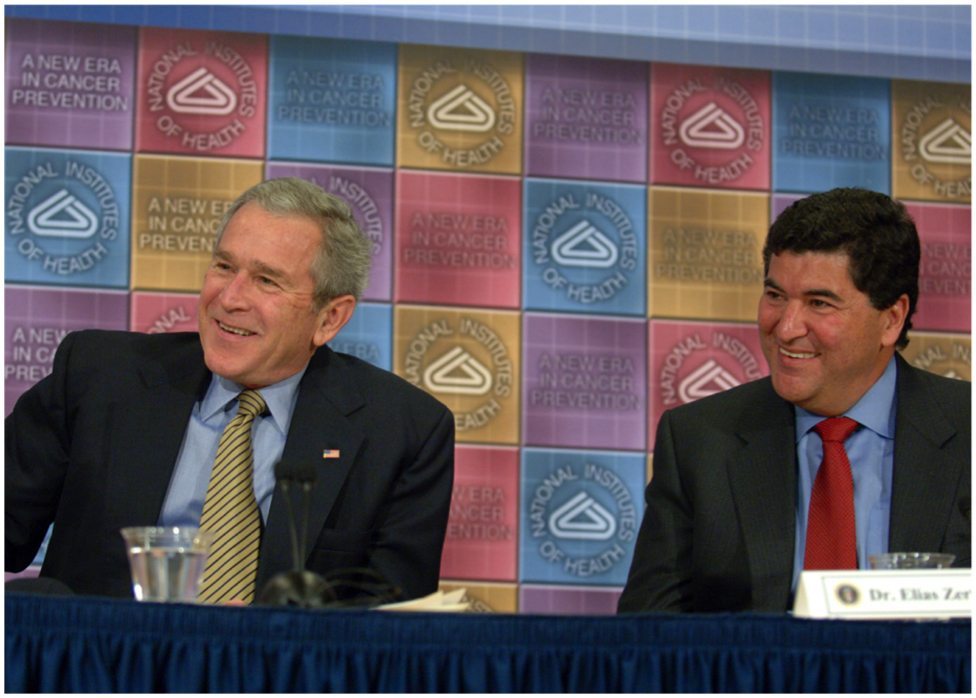

Last January at the J.P. Morgan confab, I had a chance to sit down with Sanofi R&D chief Dr. Elias Zerhouni. He made it clear up front he’s been following my writing for some years. He even seemed to have enjoyed some of it — except for the parts in which I routinely pointed to Sanofi’s lack of internal innovation and a heavy reliance on its development partners (especially Regeneron) to advance major new drugs.

This article is for premium subscribers only

Upgrade to a premium subscription plan for unlimited access, and join our community of key biopharma players.