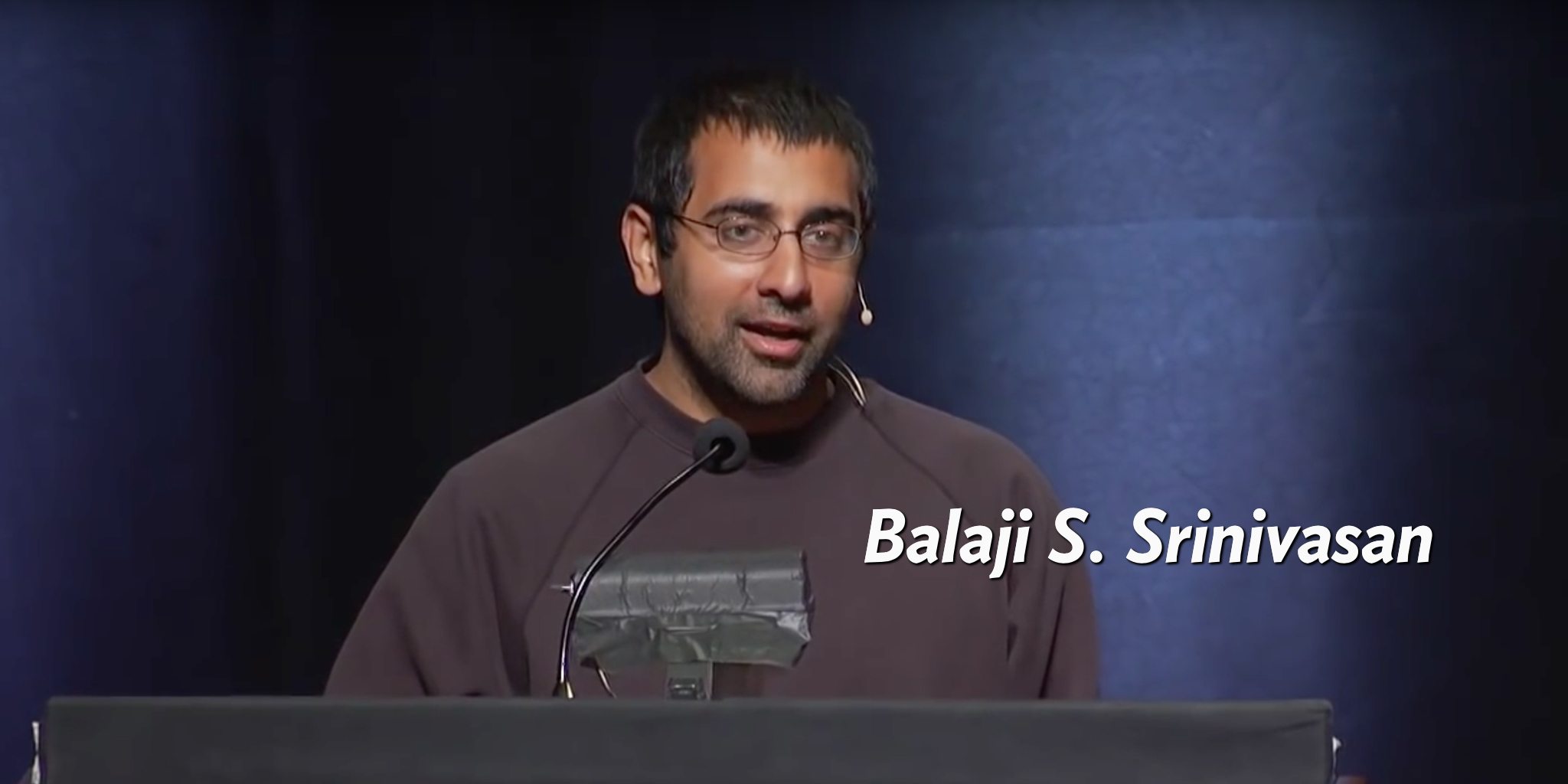

After talking to Trump about top FDA job, Balaji Srinivasan erased his barbed criticism of the drug agency

Bitcoin entrepreneur and close Peter Thiel associate Balaji Srinivasan has long enjoyed taking to Twitter to poke the FDA for being too slow at approving new therapies. By his account, the agency was guilty of considerable harm. But late Friday night, after news of his meeting on Thursday with Donald Trump for a top job at the agency spread like digital wildfire, his Twitter stream and FDA commentary all disappeared in the blink of an eye.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.