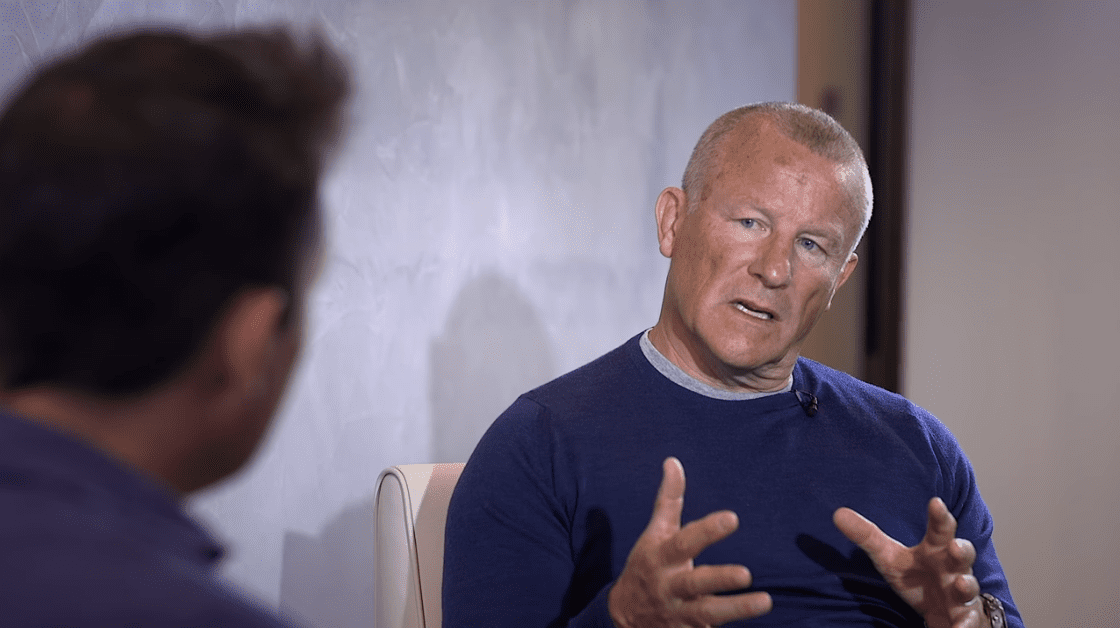

Biotech unicorns first to go as Neil Woodford auctions assets off suspended fund — report

As Neil Woodford seeks much-needed cash to end what threatens to be a prolonged suspension of his flagship fund, his biotech holdings might be the first chunk on the chopping block.

Reuters is reporting that Woodford’s overseers at Link have brought in a boutique investment bank to handle the sale, which would follow a series of smaller auctions from the frozen Equity Income Fund that reaped £300 million ($379 million) in the first month after Woodford abruptly blocked investors from pulling out. But that was clearly not enough to reopen the flagship fund — Link announced on the same day, earlier this month, that the fund would stay closed for at least another 28 days.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.