Black Diamond doubles in value hours into Nasdaq debut, marking hot start to the 2020 IPO run

There are few allosteric therapies approved, but investors seem to like the idea — and the latest duo to pursue it.

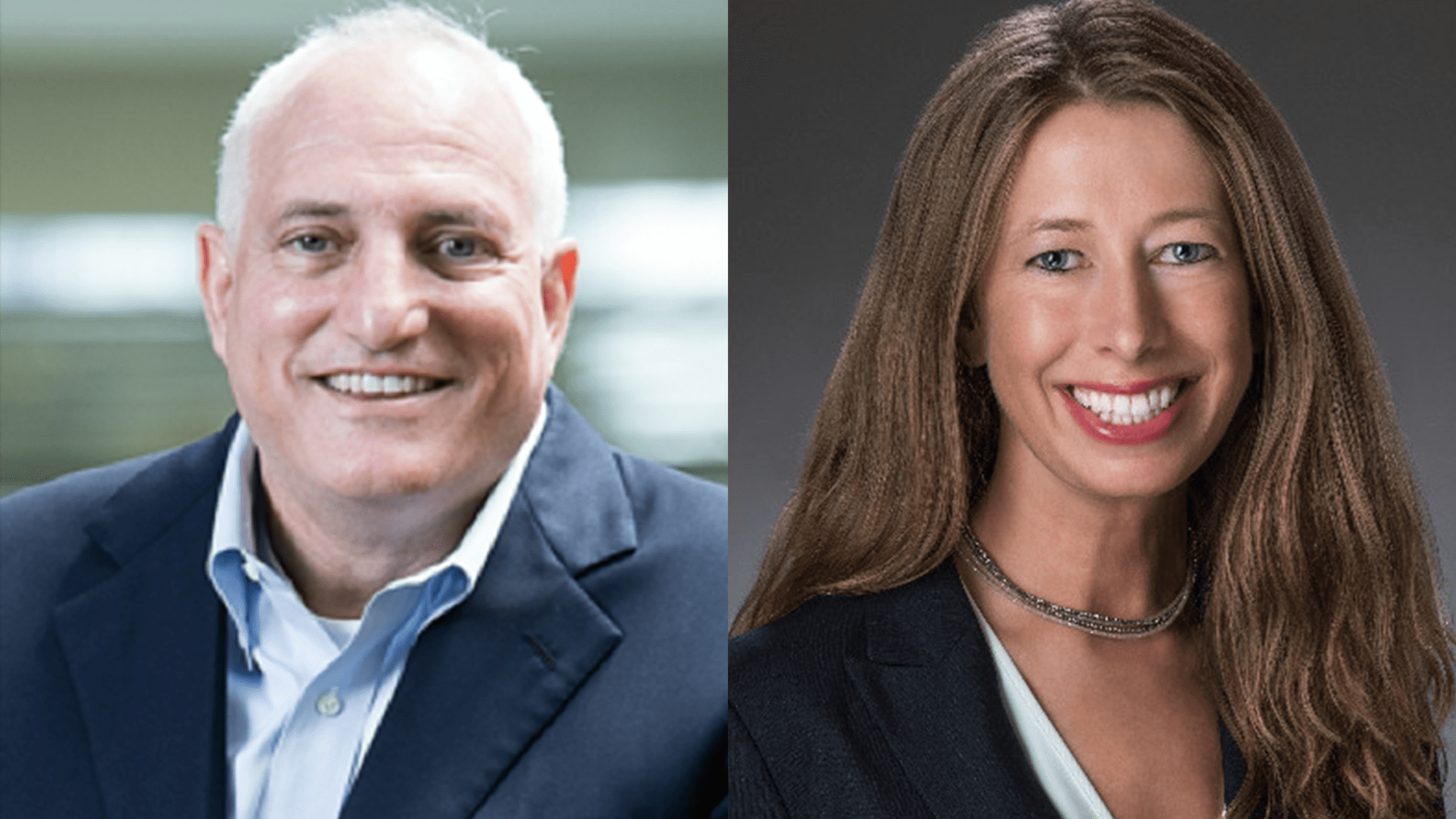

Black Diamond Therapeutics, the young oncology company from Tarceva vets David Epstein and Elizabeth Buck, opened its IPO yesterday at $19 per share. By 11:15 am, it was up to $35 per share. And, with a slight rise in the last minutes, it closed at $39.48. That’s a 108% increase on its opening tender. They collected over $200 million. The market cap doubled from around $670 million to $1.3 billion.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.