Boston jury finds biotech CEO guilty of fleecing investors, obstruction of justice

The biotech CEO who promised to end “thousands of years of morphine and opiate addiction” and allegedly told investors they could realize huge gains by investing in his company — which he said was worth $1 billion dollars before it rapidly ran out of cash — has been convicted of fraud by a Boston jury.

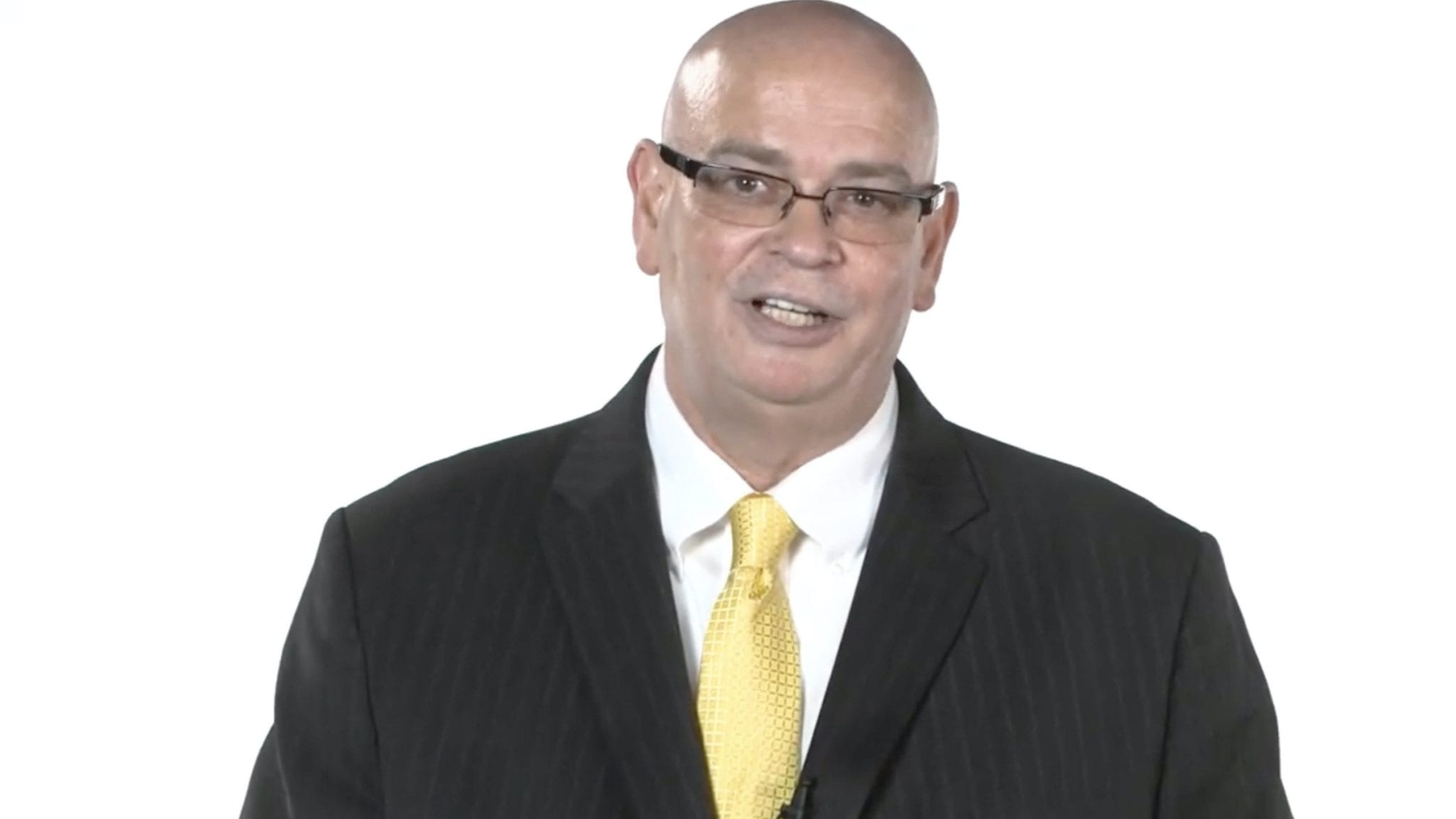

Frank Reynolds, CEO of PixarBio and former head of InVivo Therapeutics, was found guilty of lying to investors to drive up the stock price, Law360 reported. He was convicted on all counts, including securities fraud, manipulative trading and obstruction of justice.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.