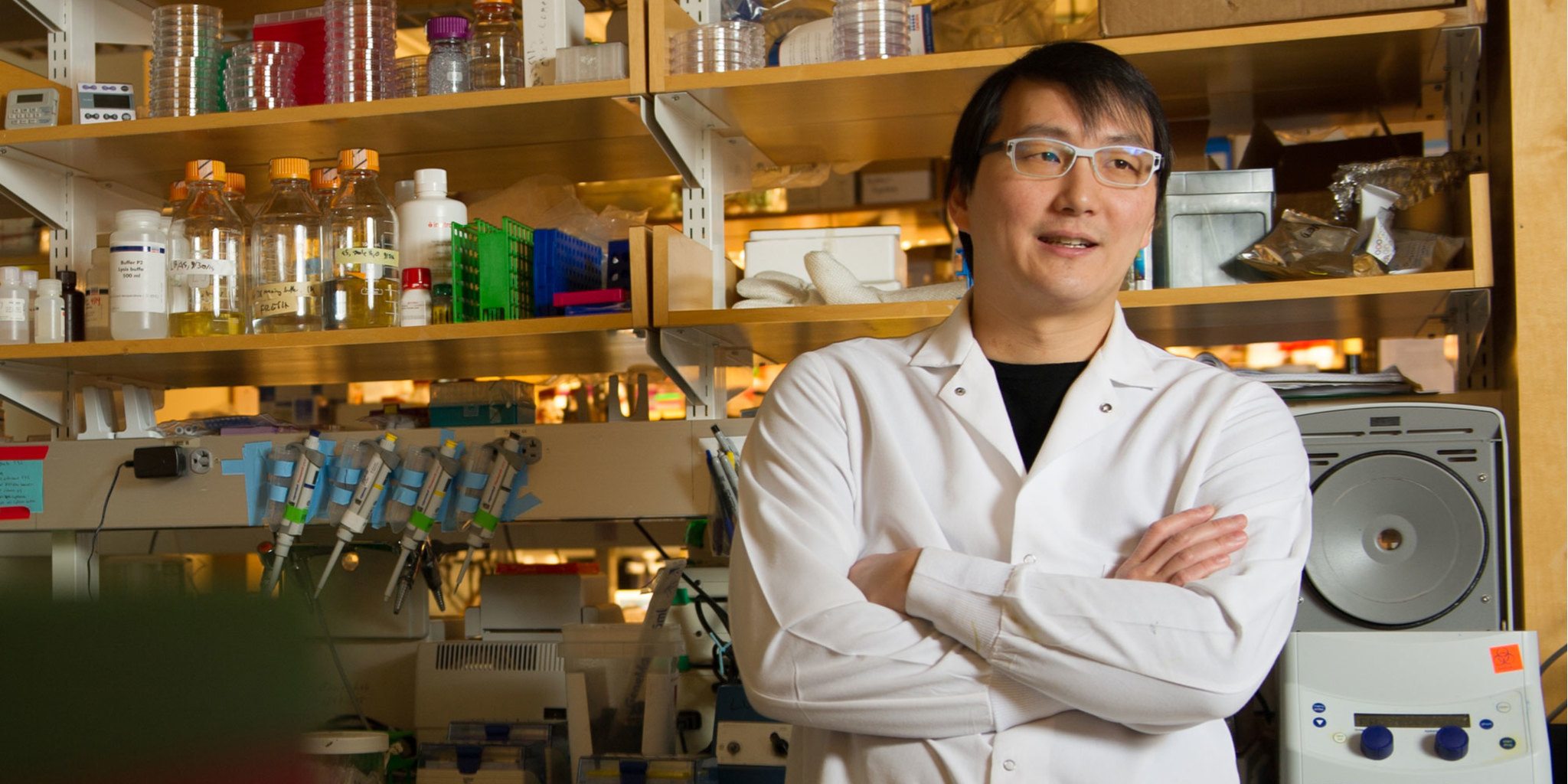

Computer science and engineering, meet drug R&D. MIT star Timothy Lu intertwines technologies for an offbeat biotech launch

At 37, Timothy Lu’s life and work has already spanned several scientific disciplines and cultures. He’s lived in Asia and the US, and after gathering degrees in electrical engineering and computer science at MIT, he struck out to pick up his medical degree at Harvard Med and then a PhD at the Harvard-MIT Health Sciences and Technology Medical Engineering and Medical Physics Program.

Knitting that all together at the Synthetic Biology Group at MIT, Lu has become one of the pioneers in the field, tackling disease by creating a genetic circuit programming platform that could one day start fixing the errant code in our genetics that triggers disease.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.