Corey Goodman's venBio closes latest VC fund — this time to the tune of $550M — with a dozen or more investments on deck

Some of the highest-profile VCs on the West Coast have cobbled together another impressive fund, one that has them more than halfway to a billion dollars.

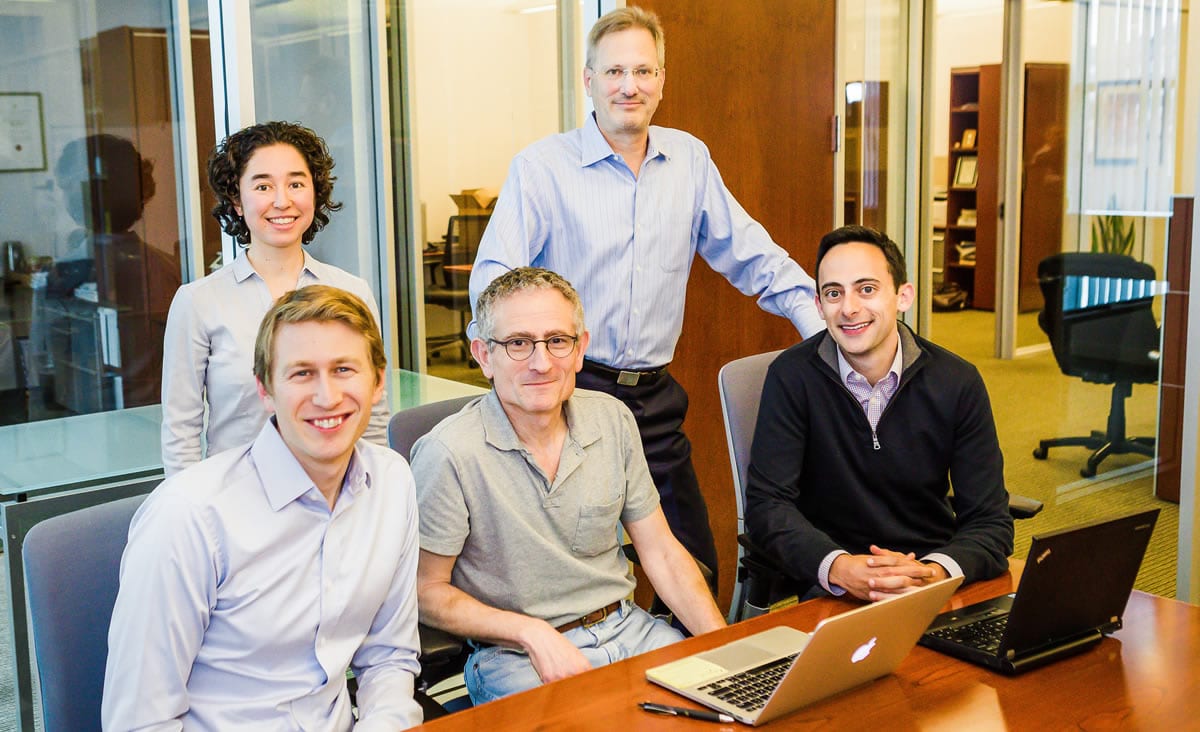

The San Francisco-based venBio has closed its fourth life sciences fund at about $550 million, the firm announced Thursday morning, led by managing partners Corey Goodman, Robert Adelman, Aaron Royston and Richard Gaster. venBio is looking to support between 12 to 15 companies with this fund, Goodman said in a statement, aiming to provide “stronger support for our portfolio companies in crossover rounds and at IPO.”

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.