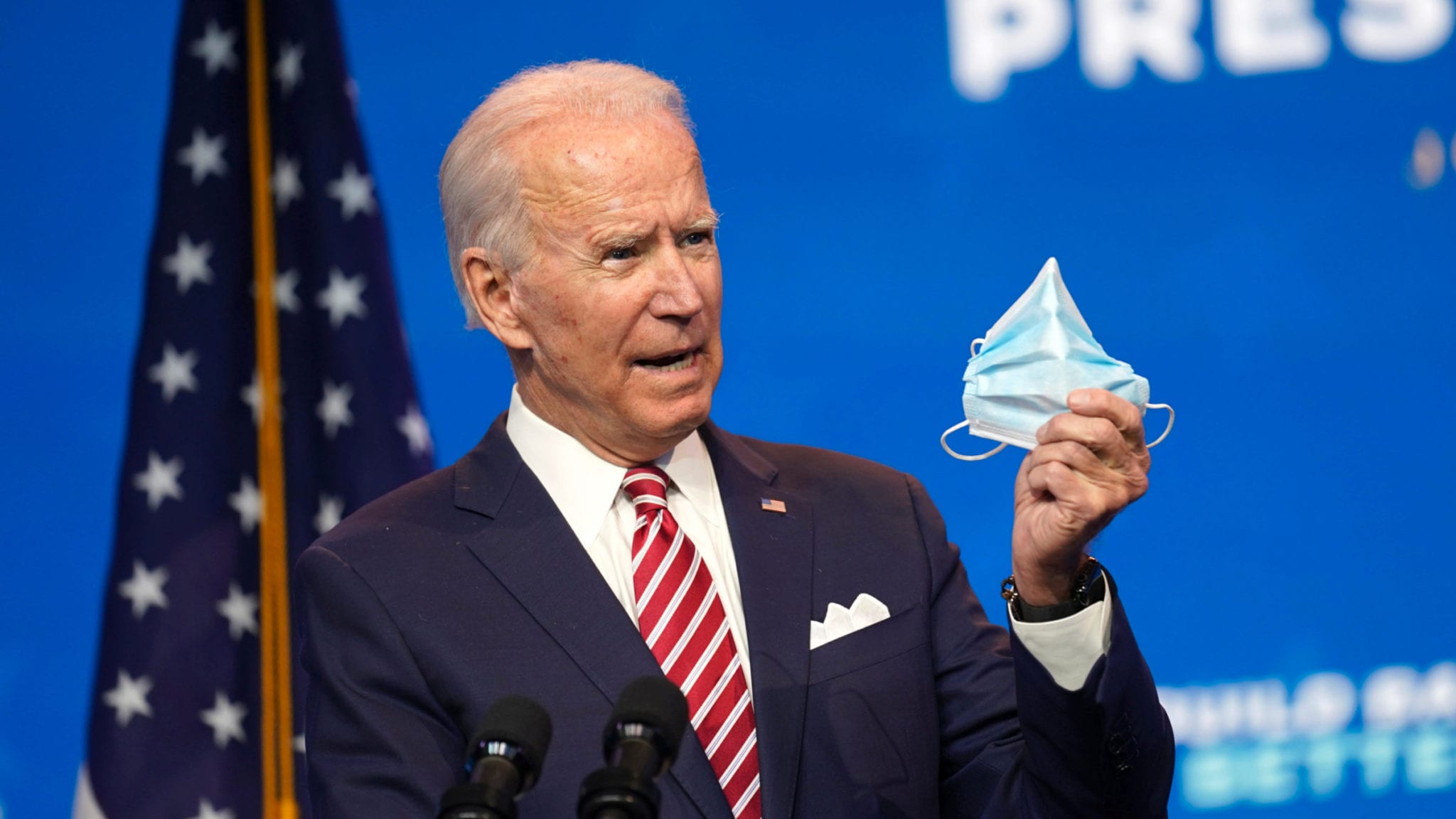

Covid-19 roundup: Pfizer, Moderna say Biden's goal of having 600M doses by July is within sight; EMA to consider expanding remdesivir authorization

Pfizer and Moderna are on track to deliver a combined 220 million doses of their mRNA vaccines in the US by the end of March, the companies told a congressional committee, setting them up to offer enough shots to vaccinate 300 million Americans by the end of July — a goal President Joe Biden has outlined in recent days.

Previously, supply wasn’t supposed to reach that level until September.

Both drugmakers say the new goal reflects significant expansions in their manufacturing capacity. And J&J said it could come in with millions of its one-shot vaccine if the FDA authorizes that third option following an adcomm scheduled later this week.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.