GSK, Pfizer to create consumer health powerhouse under JV — then spin it out

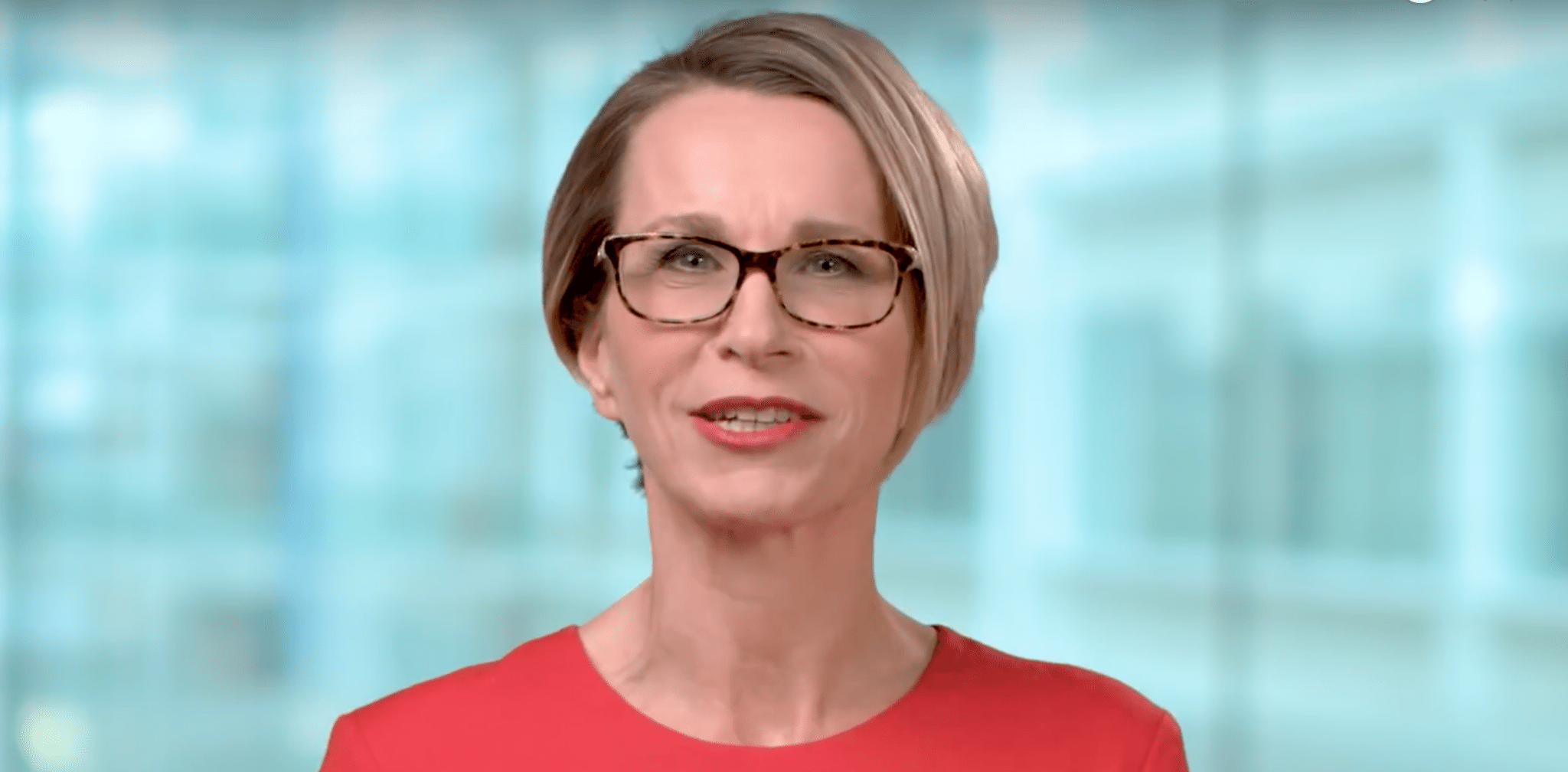

GlaxoSmithKline CEO Emma Walmsley took over the reins in 2017 with an unenviable task — to reverse the steadily eroding fortunes of the pharmaceutical giant. Her job, before rising to the helm of the British drugmaker, was head of GSK consumer healthcare. It is this unit she has agreed to eventually part with, in a deal with Pfizer $PFE announced on Wednesday.

The consumer health divisions of GSK and Pfizer — which raked in a combined $12.7 billion in sales last year — are to be merged into a joint venture, with Pfizer retaining a 32% minority stake and GSK holding the rest. Once the two businesses have integrated, GSK plans to split the company and list the JV as a separate entity on the UK equity market.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.