Ex-Celgene CEO Bob Hugin makes a leap back into biotech, joining an embattled Allergan's board

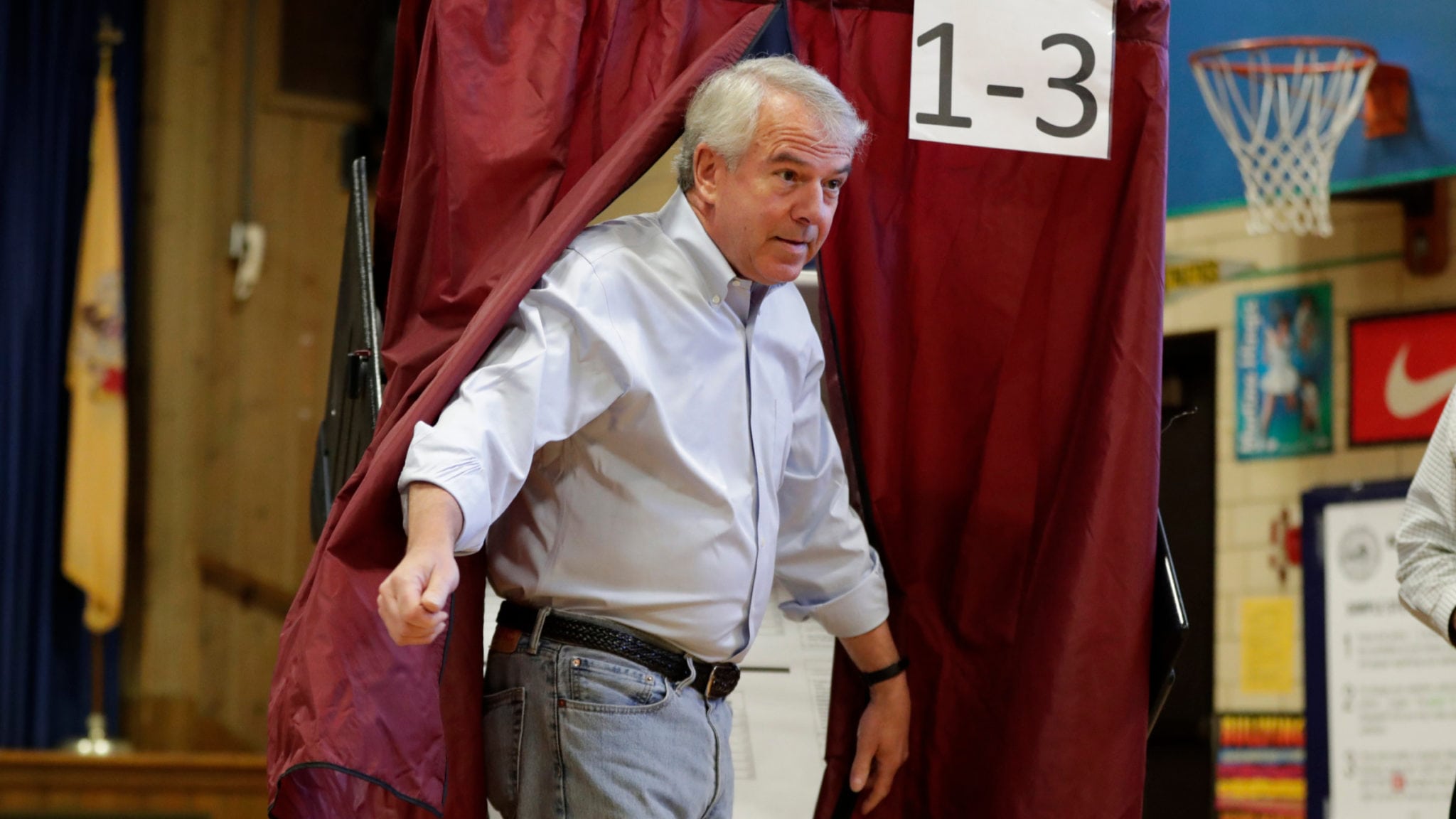

Bob Hugin is back.

The former Celgene CEO, who stepped down from the top job when the big biotech’s shares and rep were riding high in the saddle, is jumping onto the board at Allergan $AGN — which is slowly thawing to the idea of revamping its leadership structure.

Under pressure from the hedge fund Appaloosa LP to divide the role of chairman and CEO, Allergan’s board and CEO Brent Saunders used the news of Hugin’s arrival on the board to note that the company will do that — eventually.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.