Feng Zhang, heavyweight collaborators unveil latest CRISPR upstart — a diagnostic company

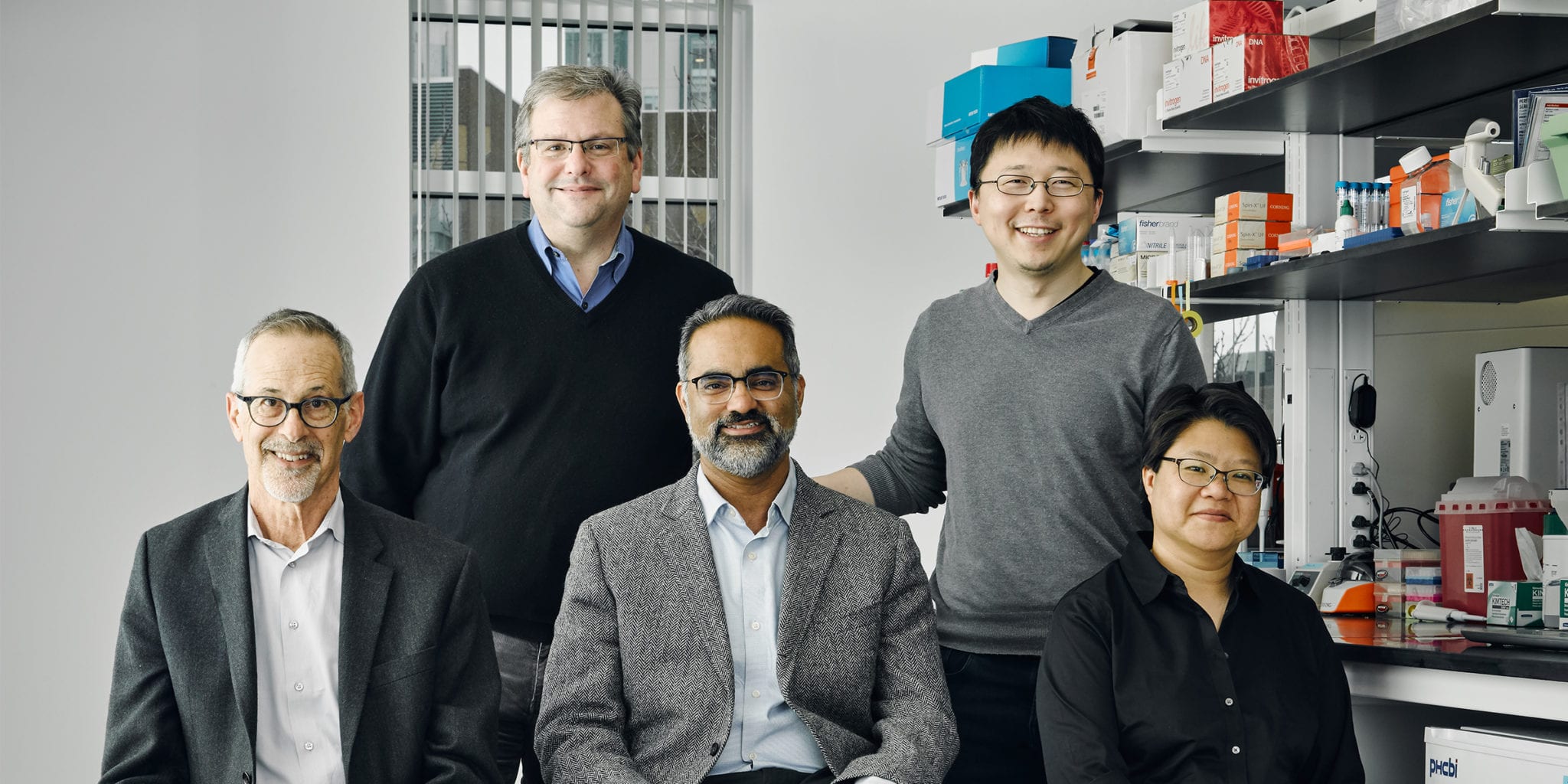

Image: David Walt, Todd Golub, Rahul Dhanda, Feng Zhang, Deborah Hung. SHERLOCK

One of the more dramatic dynamics in the academic CRISPR world involves the Broad Institute and the University of California, where Feng Zhang and Jennifer Doudna, two pioneers of the field, have their labs respectively. As the dust starts to settle on their patent dispute regarding therapeutic uses of the gene editing tech, a new storm is brewing in the diagnostic applications of CRISPR.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.