Following up on Trump's orders, the FDA wants to know: which regulations and paperwork requirements need to go?

As part of work under two executive orders, FDA centers on Thursday sought comments on which existing regulations and related paperwork requirements could be modified, repealed or replaced, to reduce the burden on industry while allowing the regulator to continue its public health mission while fulfilling statutory obligations.

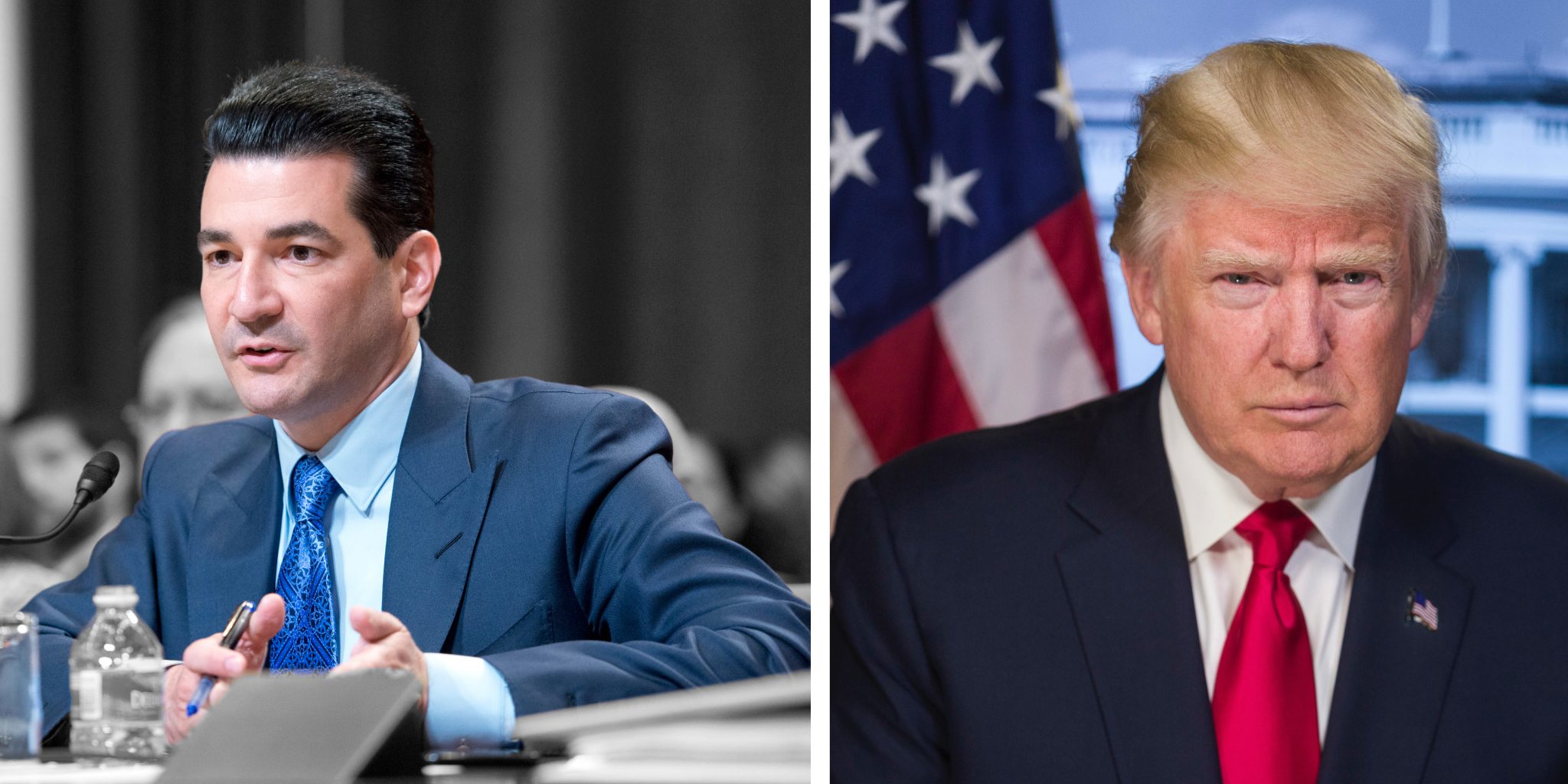

Back in February, when President Donald Trump first announced his order to reduce regulatory burdens, several experts pointed Focus to some outdated regulations that could be removed with little impact on public health and the agency’s mission, though there are still questions as to what types of regulations will be targeted.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.