Forget Bristol-Myers: Regeneron takes on Merck for the heavyweight title in non-small cell lung cancer

Regeneron may have been the 6th biopharma company to land an initial approval for a PD-1/L1 therapy, but they’re clearly not settling for anything close to a last-place finish in the amazing race for market dominance in the mega-blockbuster field.

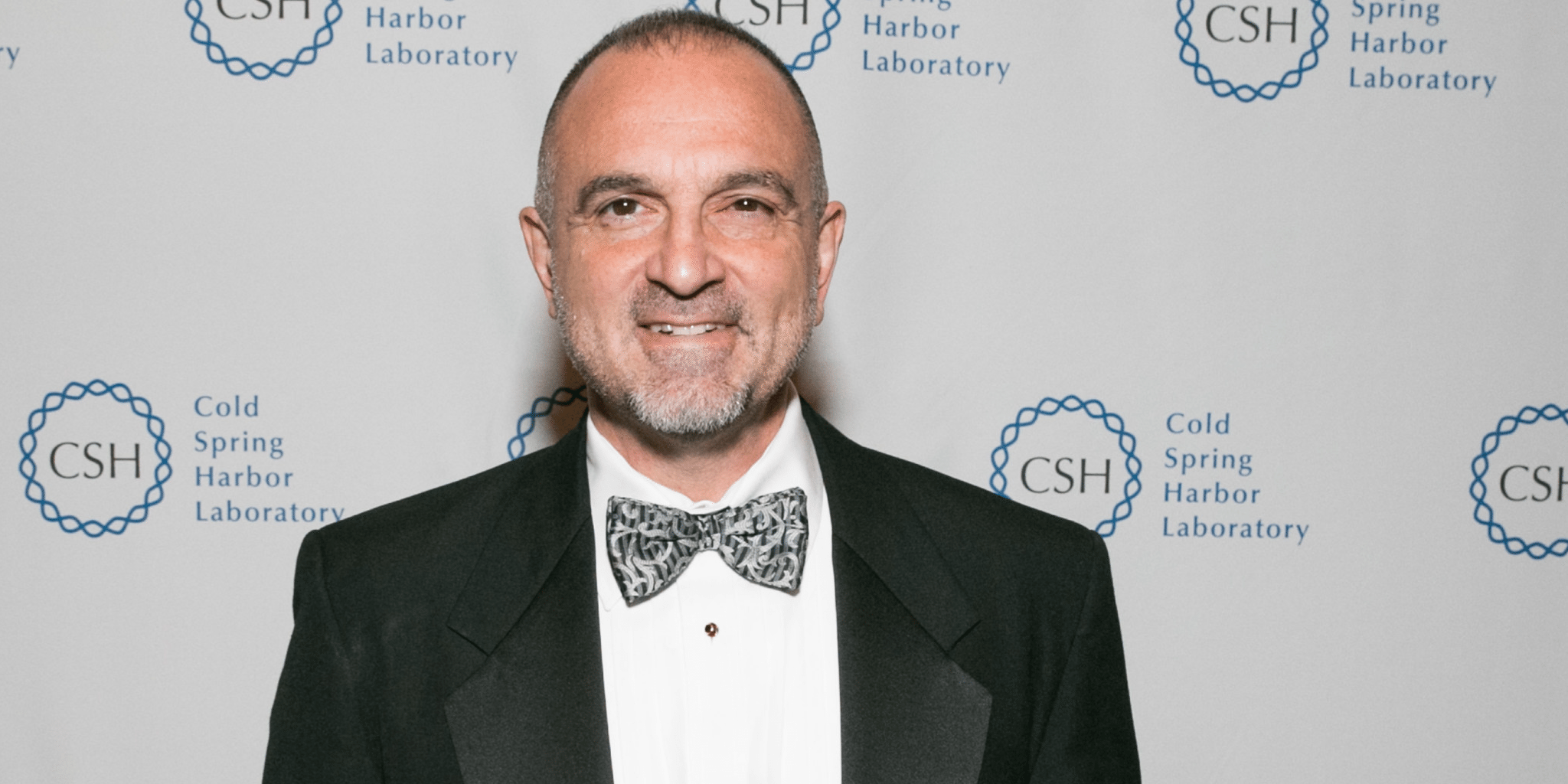

In their Q4 call with analysts on Thursday, Regeneron’s not-shy R&D chief George Yancopoulos touted their capture of the lead role among checkpoints in treating advanced cutaneous squamous cell carcinoma. In an interview with Endpoints News last month, Yancopoulos made so secret of his opinions about the PD-L1s on the market, slamming them all as second-rate and assigning worst-in-class status to Bavencio from Pfizer and Merck KGaA. But they’re also moving to challenge giant Merck’s Keytruda — another PD-1 — on one of its major achievements: winning an OK as a monotherapy for frontline use in non-small cell lung cancer.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.