Gilead reports 'very strong quarter' despite slipping Veklury sales

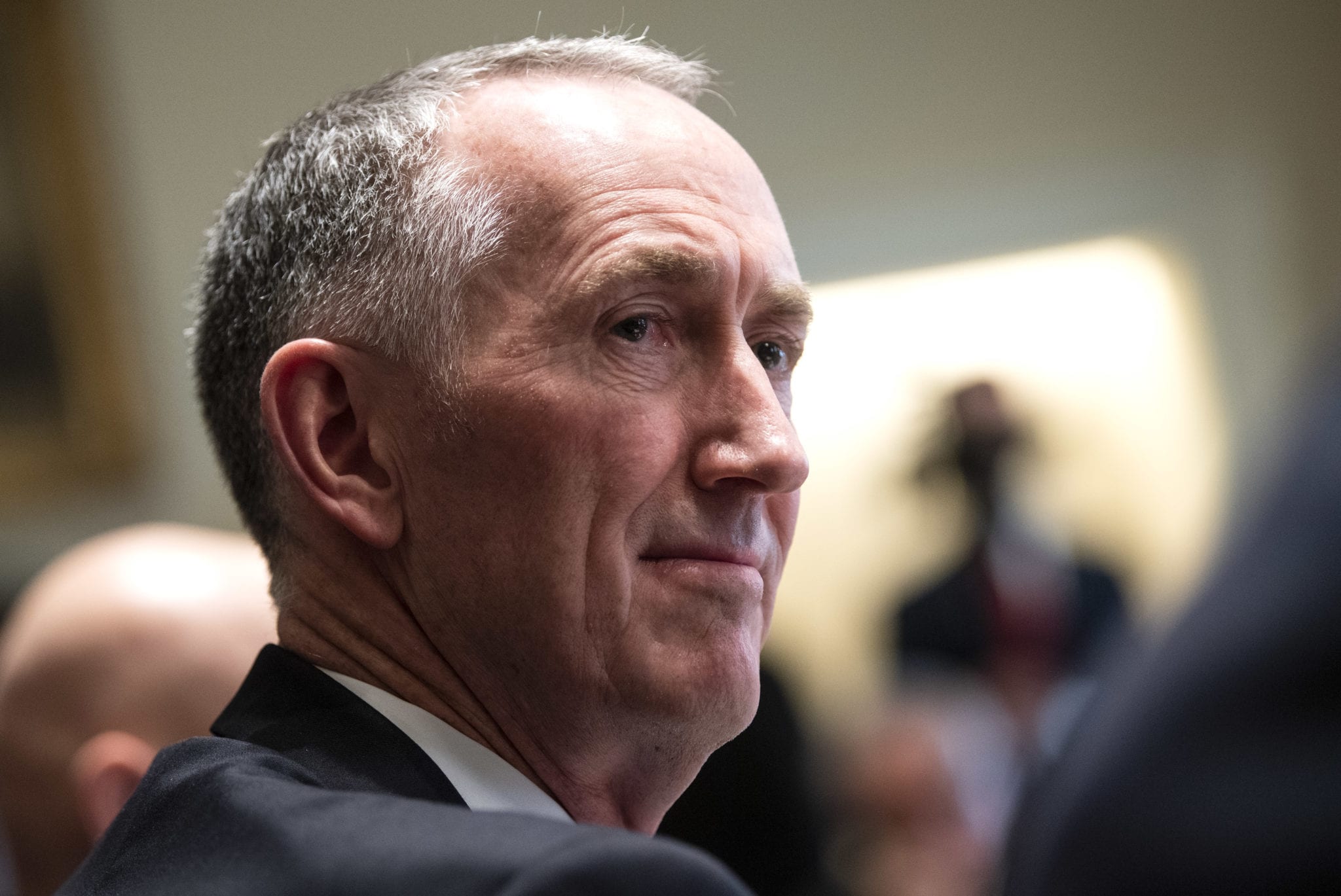

Gilead CEO Dan O’Day uncorked some solid Q2 results on Tuesday, touting a surge in Yescarta and Trodelvy sales and an uptick in demand for HIV med Biktarvy. Will sinking Covid sales spoil the party?

Veklury sales were down 48% last quarter, topping out at $445 million. That decline was expected, chief commercial officer Johanna Mercier noted, as hospitalization rates fall due to milder cases and the uptake of other treatments like Pfizer’s Paxlovid. Even so, roughly 60% of hospitalized Covid patients are treated with Veklury, she added.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.