GlaxoSmithKline punts a key Zejula combo study in ovarian cancer with added setbacks on ICOS and RSV

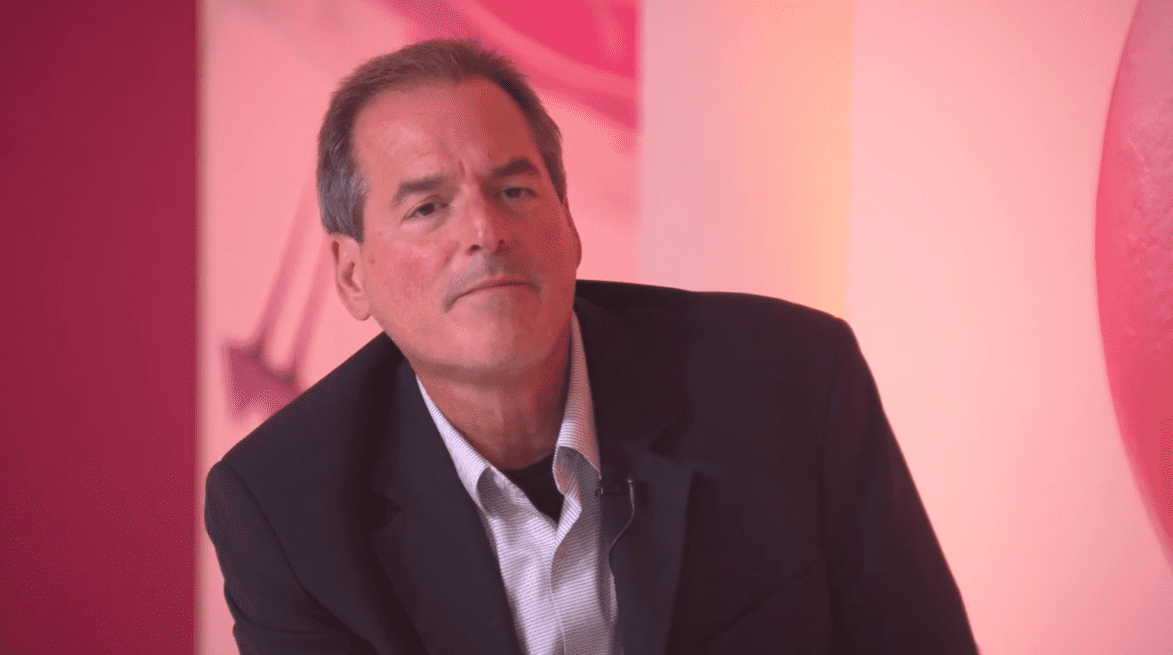

A chink has appeared in the armor of data that GlaxoSmithKline R&D chief Hal Barron has been building for the PARP inhibitor Zejula.

The pharma giant’s Q2 update on Wednesday includes the note that researchers have ended their Phase II MOONSTONE study, one of a slate of trials that Barron has cited to “help establish Zejula as the most compelling PARP inhibitor for women with ovarian cancer.”

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.