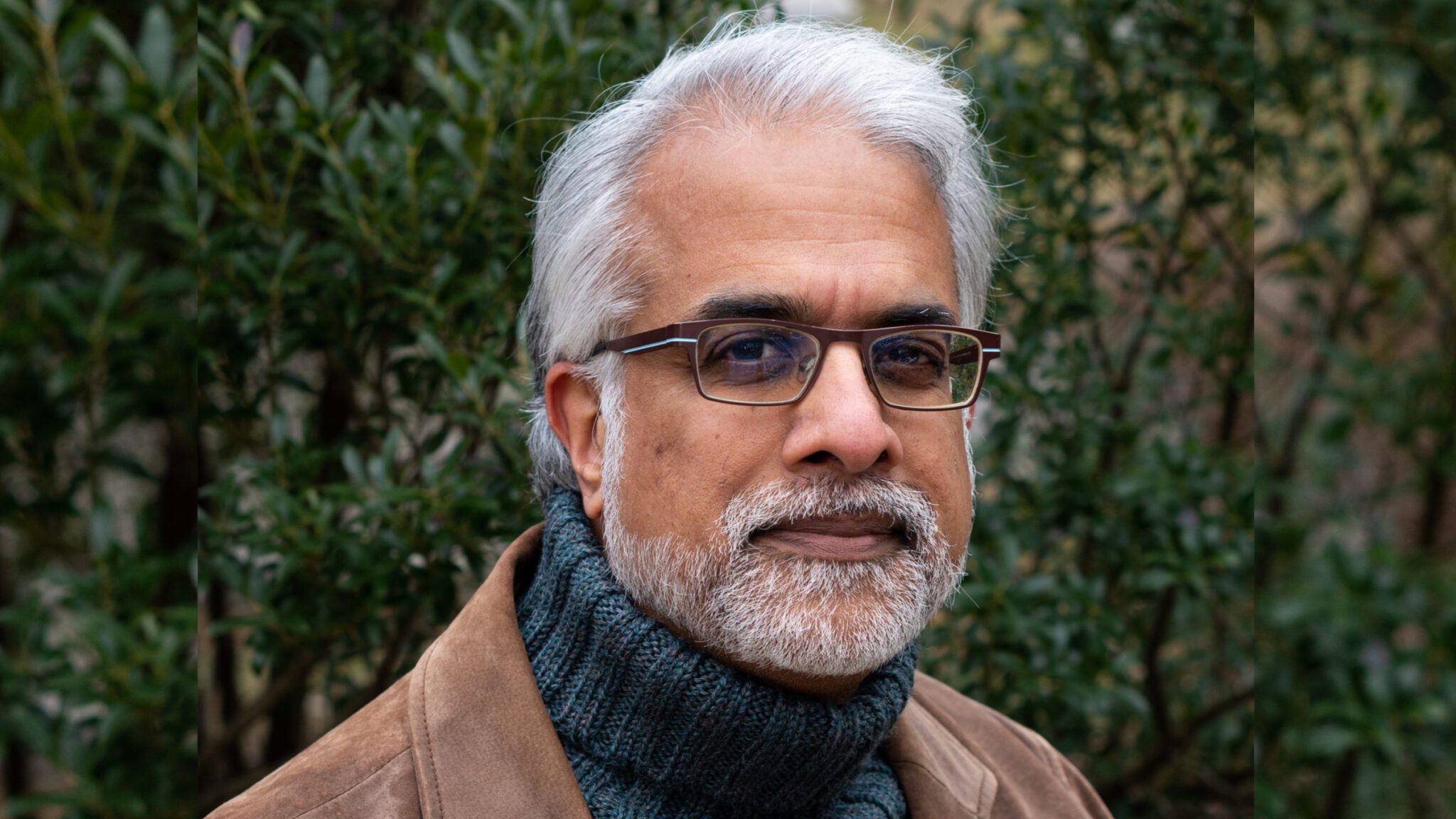

Going so soon? Scholar Rock CEO makes swift exit, leaving Nagesh Mahanthappa back at the helm

Just over a year after taking the helm at Cambridge, MA-based Scholar Rock — and just as the company prepares to send its lead spinal muscular atrophy candidate to Phase III — CEO Tony Kingsley is already on his way out.

According to an SEC filing, the Biogen vet’s departure “was not the result of any disagreement with the Company on any matters relating to the Company’s operations, policies or practices.”

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.