Going to China? ADC Therapeutics spotlights a new way to do it with Hillhouse-backed Overland

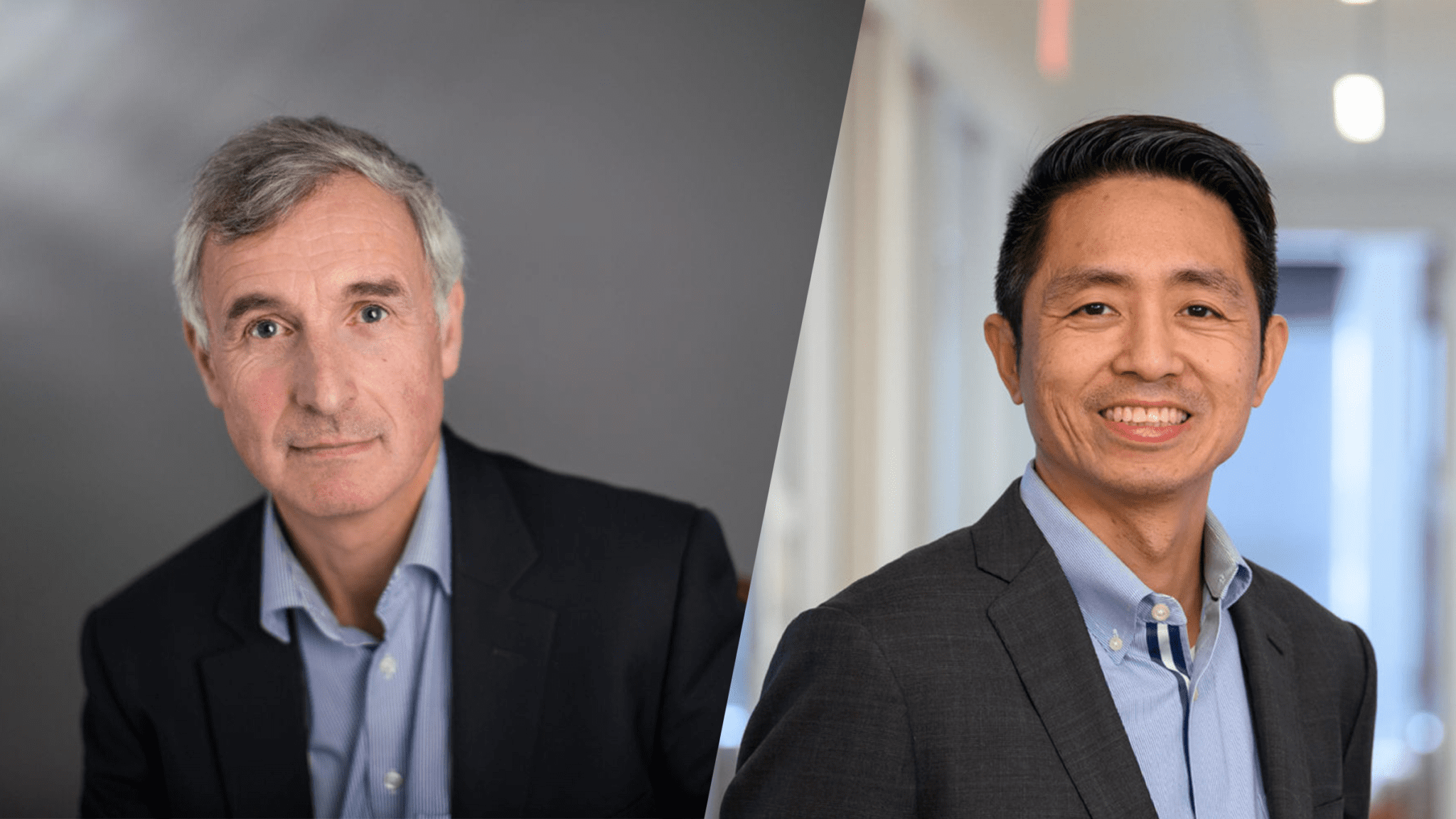

Chris Martin and his crew at ADC Therapeutics went into the JP Morgan Healthcare conference this January armed with positive pivotal data for its lead antibody-drug conjugate, loncastuximab tesirine. Having focused its development program exclusively in the US and Europe, it was time to find a Chinese partner.

The search, which stretched out over the next few months, culminated in six term sheets, from large pharma, oncology specialists and all. But one bidder stood out: Overland Pharma, the fledgling platform play co-founded by venture partners at Hillhouse Capital, a marquee VC firm Martin has come to respect.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.