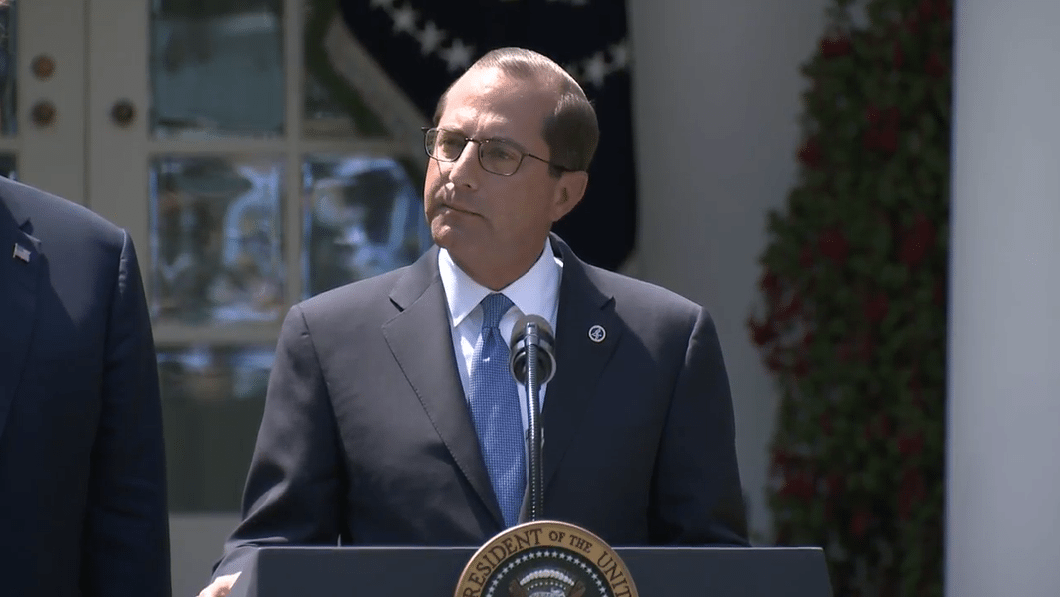

HHS Secretary Azar pitches naming and shaming tactics on drug price campaign, singling out Celgene's Revlimid

Celgene $CELG wasn’t singled out by name in a speech by HHS Secretary Alex Azar Monday, but the big biotech got cast in the role of main villain in his outline of what ails Medicare — and how that should be fixed.

The price on Celgene’s widely used Revlimid — Evercore ISI’s Umer Raffat made the connection to Azar’s speech in a note Monday afternoon — was jacked by 20% over the last year, which means that Medicare patients pay an extra $115 month, moving from $575 to $690 per month, for their share of a drug that had cost $11,500 a month in 2015.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.