Human Longevity makes a move toward Nasdaq with potential SPAC deal, but nothing's final yet

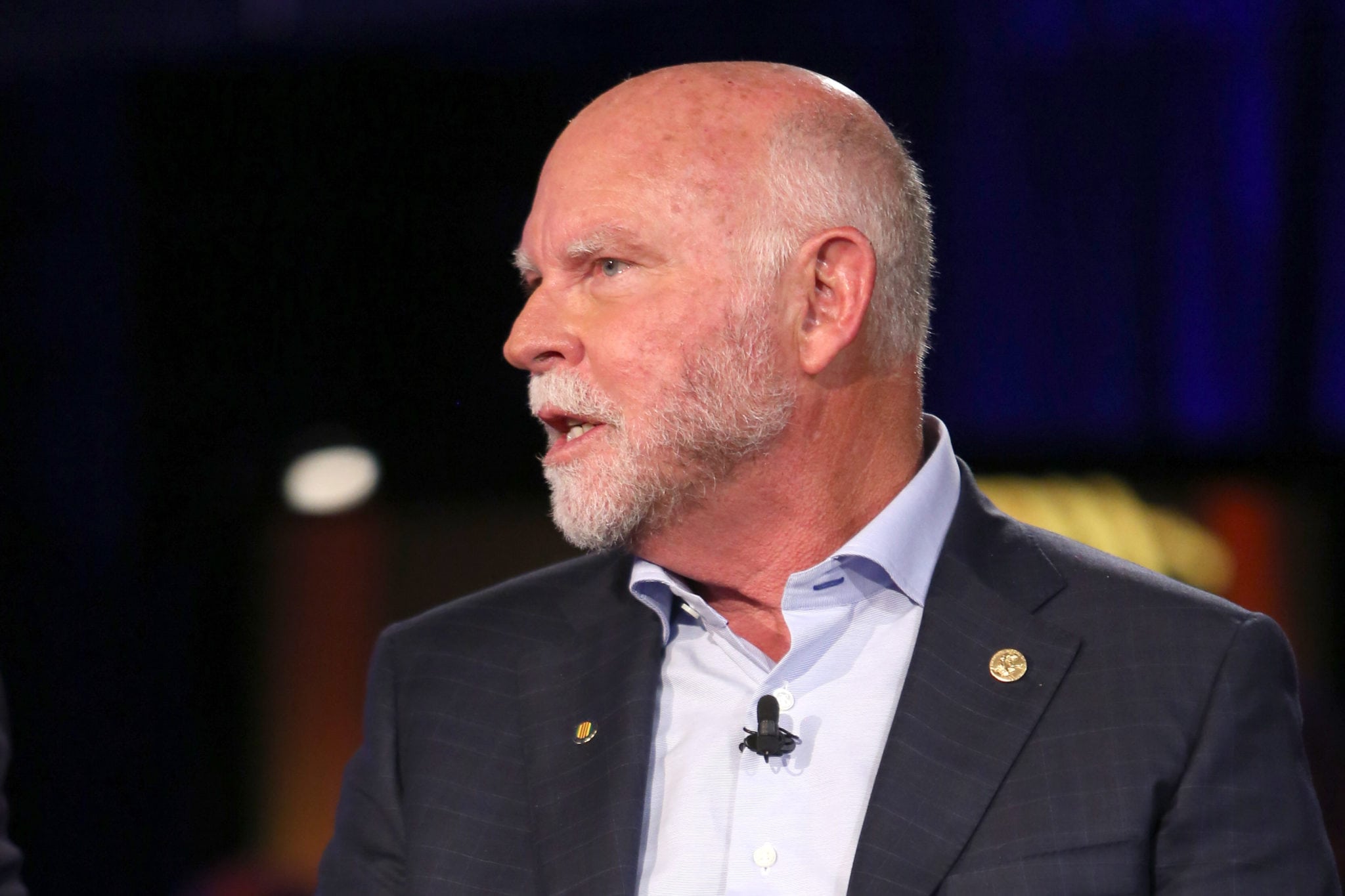

Anti-aging company Human Longevity, founded by pioneering genomic researcher Craig Venter, is one step closer, potentially, to becoming a public company.

The startup put out a press release Monday afternoon saying it has signed a “letter of intent” to reverse merge with a SPAC run by former Credit Suisse CEO Tidjane Thiam, known as Freedom Acquisition I Corp. If none of the SPAC investors redeem their shares and pull out at the float price of $10, Human Longevity will receive $345 million.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.