Humana spells out its conditional Exondys 51 coverage policy — strings attached

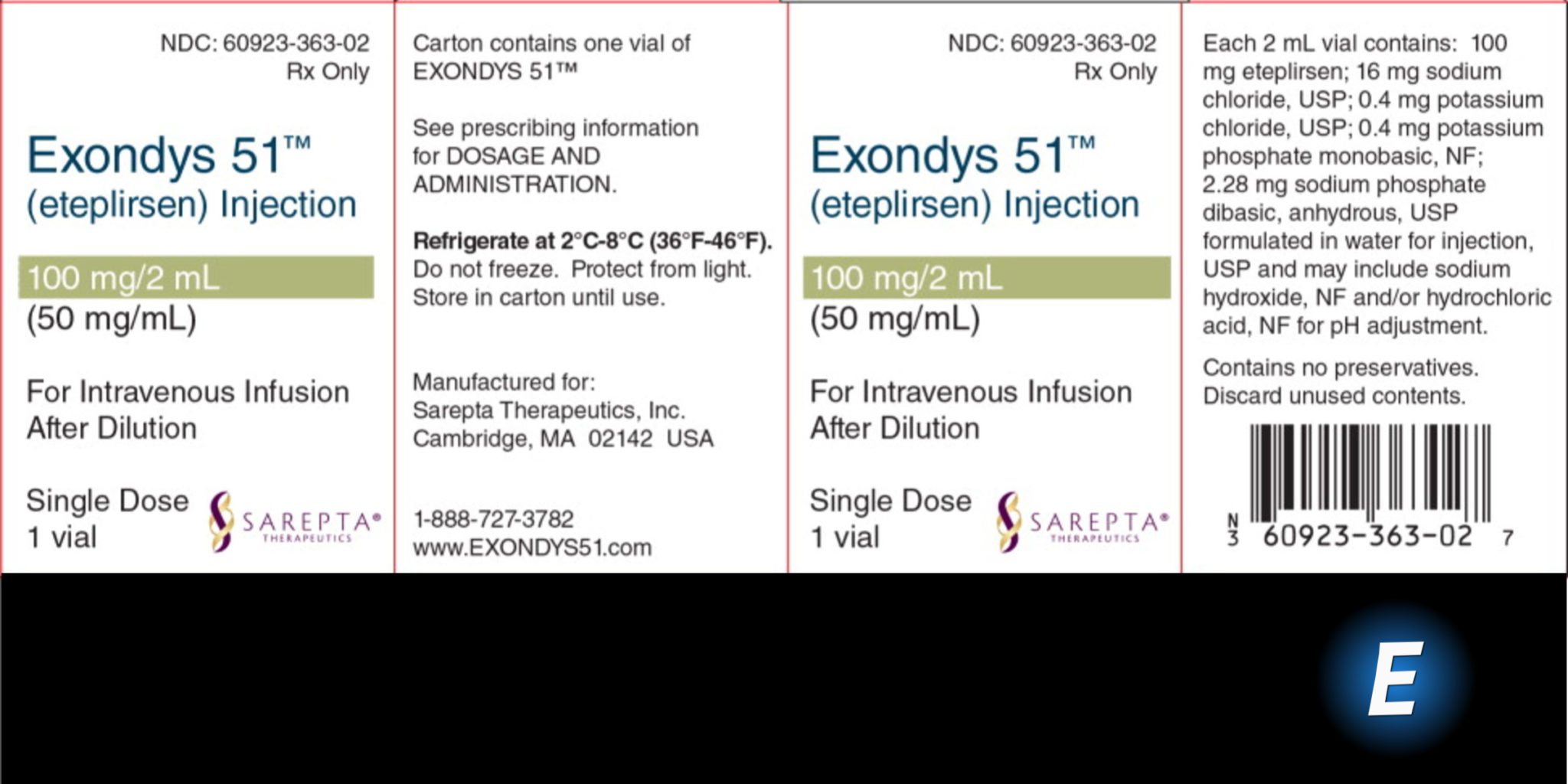

Humana’s decision to cover Sarepta’s $SRPT controversial Duchenne muscular dystrophy drug Exondys 51 (eteplirsen) comes with some thick strings attached to it.

In a new coverage policy posted at the big insurer, Humana says that it will only provide coverage for the $300,000-plus therapy provided patients are still ambulatory, continue to prove that they remain able to walk and meet the criteria for patients who may benefit from an Exon 51-skipping drug.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.