Japanese billionaire Hiroshi Mikitani bankrolls Aspyrian with a $150M mega-round, backing a global rollout plan for PhIII cancer therapy

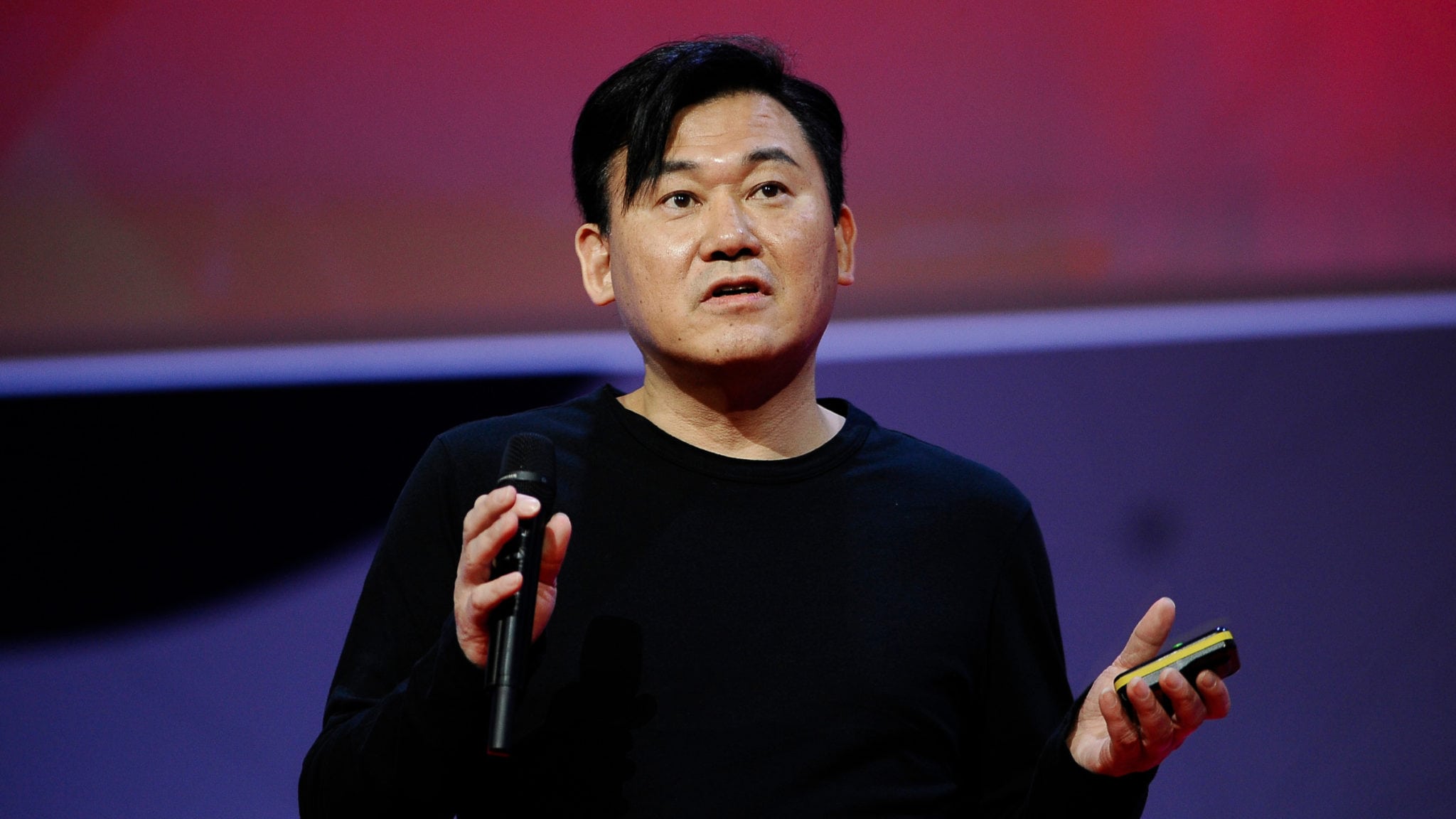

Among the world’s billionaires, Hiroshi Mikitani is one of the most prominent enthusiasts. Starting with 6 staffers and a small sum of cash, he turned Rakuten into an online powerhouse in Japan that is ranked among the world’s top e-tailers. An iconoclast in an economy dominated by traditionalists, he’s mandated that everyone in his company learn and speak English as their first language. His recent ventures include a partnership with Walmart for an online supermarket in Japan.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.