Johns Hopkins spinout spotlights a showcase animal test for antibody-ligand I/O traps — matching checkpoints with a rein on Tregs

With the blockbuster popularity of PD-1/L1 checkpoints changing the way tumors are treated around the world, the spotlight in research has shifted away from the successful though limited and somewhat crude first generation of these therapies to new ways to amp up their efficacy and durability.

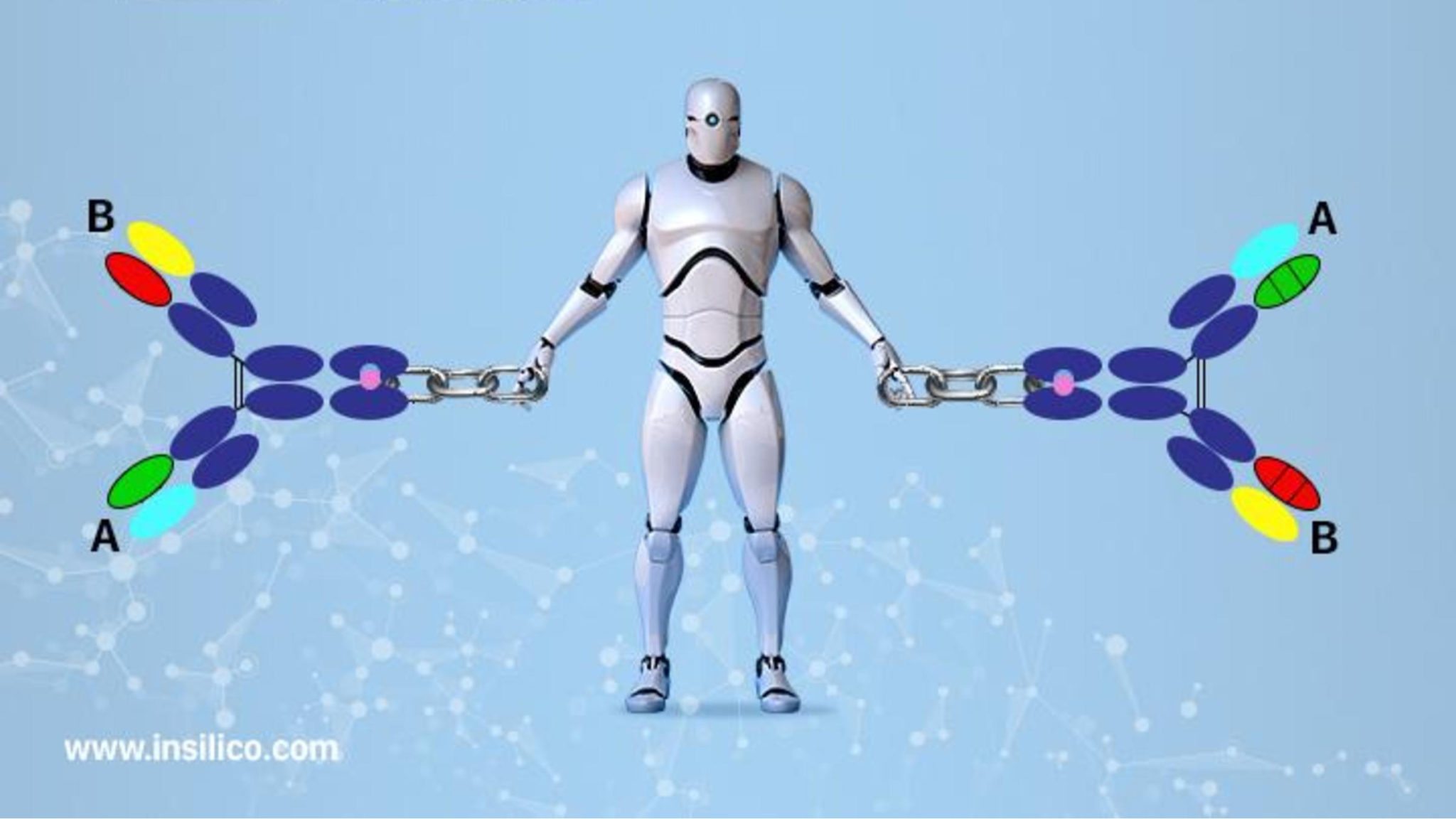

One of the key hurdles, investigators have found, is the generation of regulatory T cells — Tregs — that suppress the immune response to cancer cells. And now a research team at Johns Hopkins led by Atul Bedi, a practicing oncologist and associate professor at Johns Hopkins University School of Medicine, say they have developed an antibody/ligand with a bifurcated warhead that can do a better job on the checkpoint side while blunting the Tregs that both prevent efficacy as well as help trigger a gradual loss of potency, leading to recurrence.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.