Khosla bets big on SPAC boom, raising $1.2 billion for 3 vaguely targeted blank-check companies

Khosla Ventures had largely sat out the past year’s SPAC boom. That changed late last week, though, when the prominent Silicon Valley VC filed for three blank check companies at once, promising to raise $1.2 billion to find and eventually take three different impactful companies public.

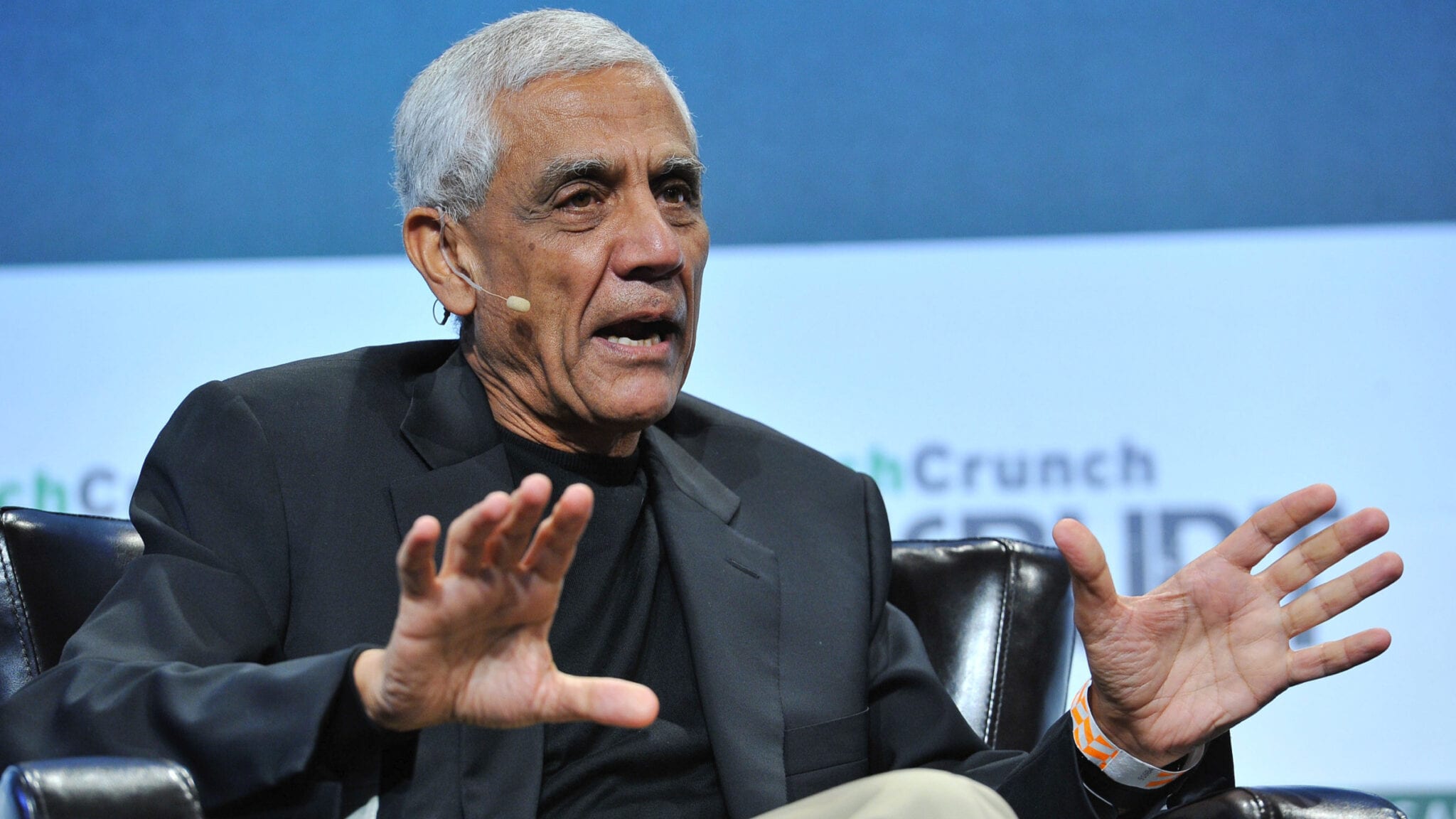

Khosla didn’t offer much detail on what fields or industries they are aiming for, with managing partner Vinod Khosla writing instead a brief but polemical letter on the importance of startups and reinvention and the value of being George Bernard Shaw’s unreasonable man. They also used the copy-paste function to write most of the S-1 for what will be known as Khosla Ventures Acquisition Co. II, and Khosla Ventures Acquisition Co. III, so it’s difficult to get a gauge on where the firm plans on targeting their shell corporations.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.