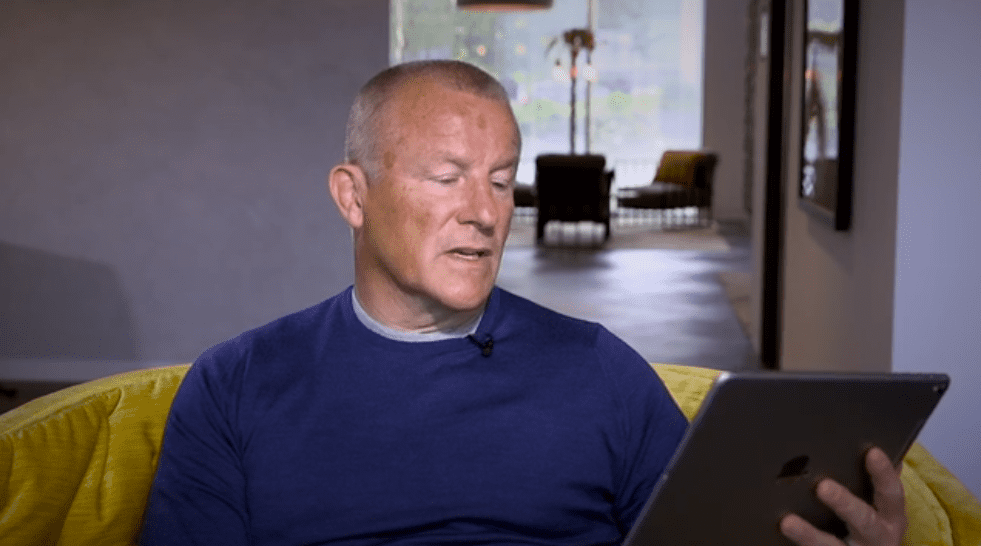

Neil Woodford refreshes portfolio with fire sale while investors ponder future of suspended fund

Ahead of an expected update on the suspension of his flagship fund, Neil Woodford has reportedly raised £459 million from share sales across his portfolio of funds, Citywire reports.

The investment management firm is holding some of it in cash while putting the rest to use in other stocks, a spokesperson told Bloomberg — which counts at least £300 million ($379 million) in sales from the frozen Equity Income Fund. Selling off illiquid or unlisted assets is key to Woodford’s turnaround mission for the fund, which was suffering from an exodus of investors that shrunk the fund from £10.2 billion to £3.7 billion in two years and squeezed its ability to meet any further redemptions.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.