Novartis ties up with the virtual biotech Parvus to try a new approach on Type 1 diabetes

Novartis has turned to a small, virtual biotech in Canada for some fresh inspiration on how it might one day defeat Type 1 diabetes.

The pharma giant’s Novartis Institute of Biomedical Research now has the exclusive license to use Parvus Therapeutics’ platform for diabetes, coming in with an unspecified package of milestones, an upfront, research support and an equity stake to seal the deal.

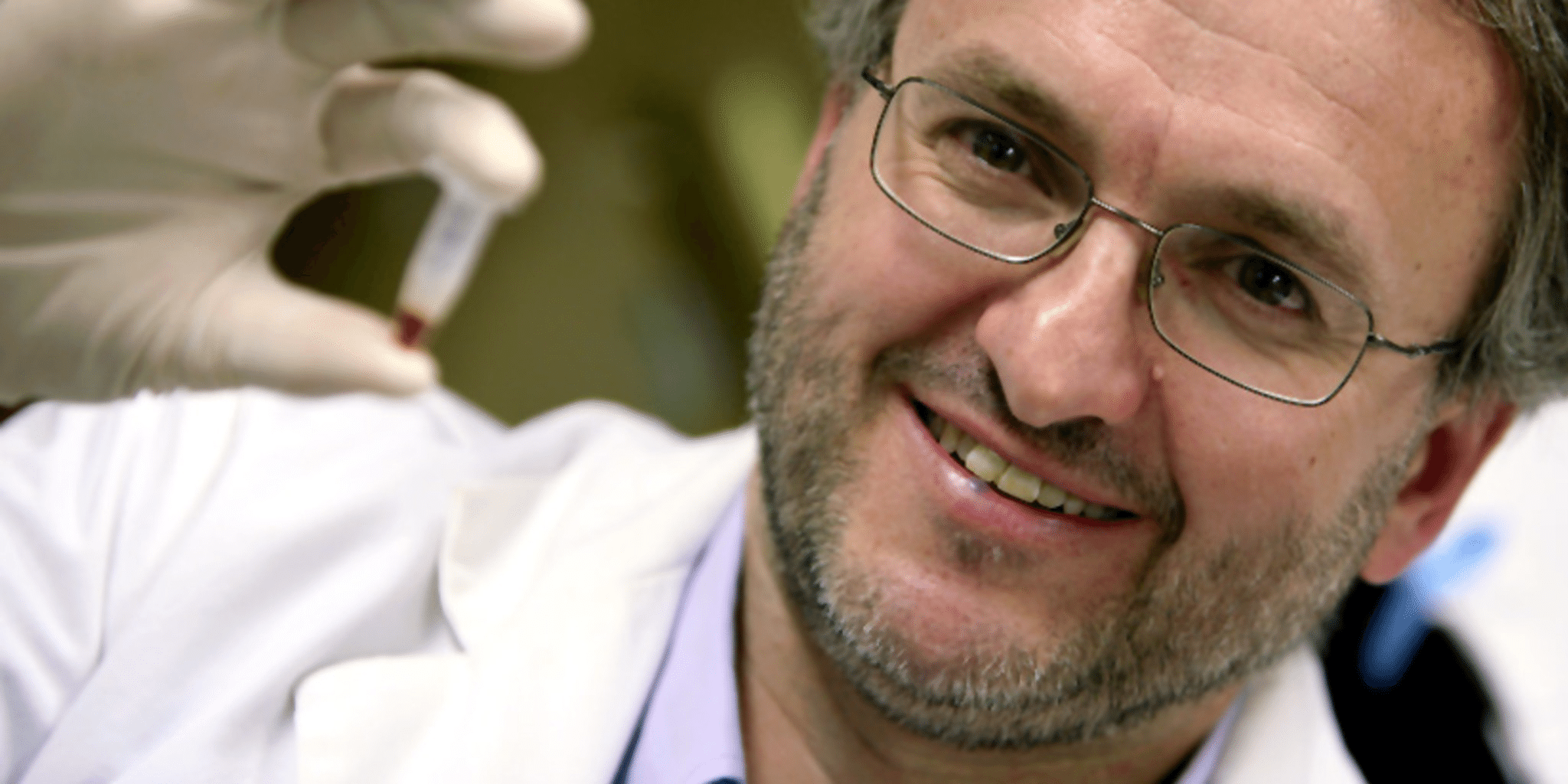

That’s a very big deal for Parvus, which has been operating for the last few years on about $20 million in research grants and $5 million in angel investments with a few full-time staffers to guide the work being done in Pere Santamaria’s lab at the University of Calgary.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.