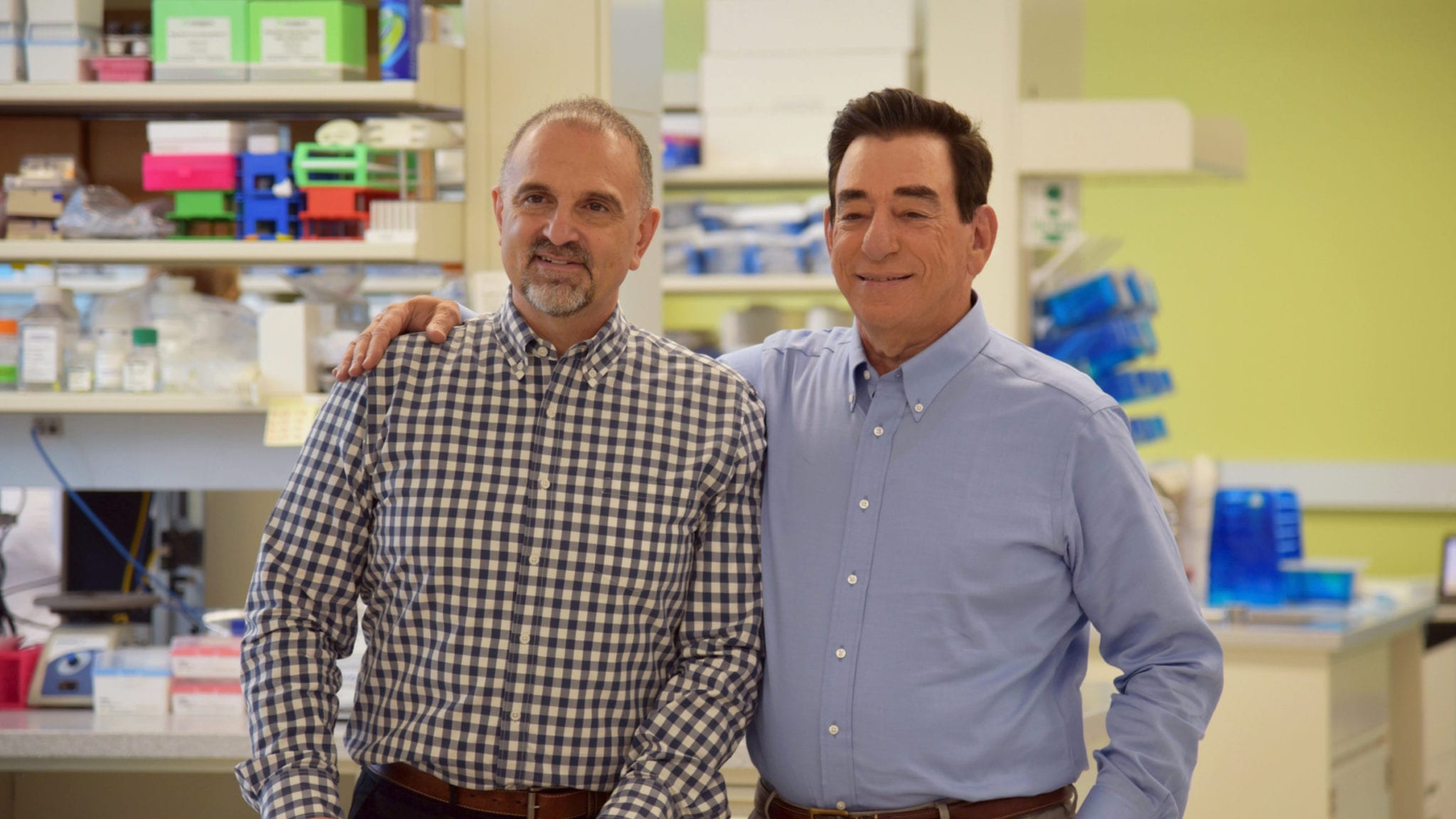

Regeneron's Len Schleifer, George Yancopoulos start their ambitious 5-year plan, earning a front-loaded $270M combined

As biotech whiz kid Regeneron prepares to move into the next phase of its growth, founding partners Len Schleifer and George Yancopoulos placed a big bet on themselves late last year with a long-term performance plan worth a potential $1.4 billion. Now — with those front-loaded, conditional stock awards in the bank —can both men stick the landing?

Schleifer and Yancopoulos earned $135 million and $134 million, respectively, in 2020 on the back of the New York drugmaker’s work advancing one of the earliest antibody cocktails for Covid-19 through an FDA emergency use authorization, according to a proxy filing with the SEC.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.