Resistant to CAR-T therapies? It's the cancer, not your immune system — study

Safety concerns and manufacturing shortcomings aside, existing CAR-T therapies — Novartis’ Kymriah and Gilead’s Yescarta — simply don’t work in 10% to 20% of patients with B cell malignancies. What factors underpin this resistance to CAR-T therapy? The main culprit could be the cancer cells themselves, according to a team of researchers at Penn.

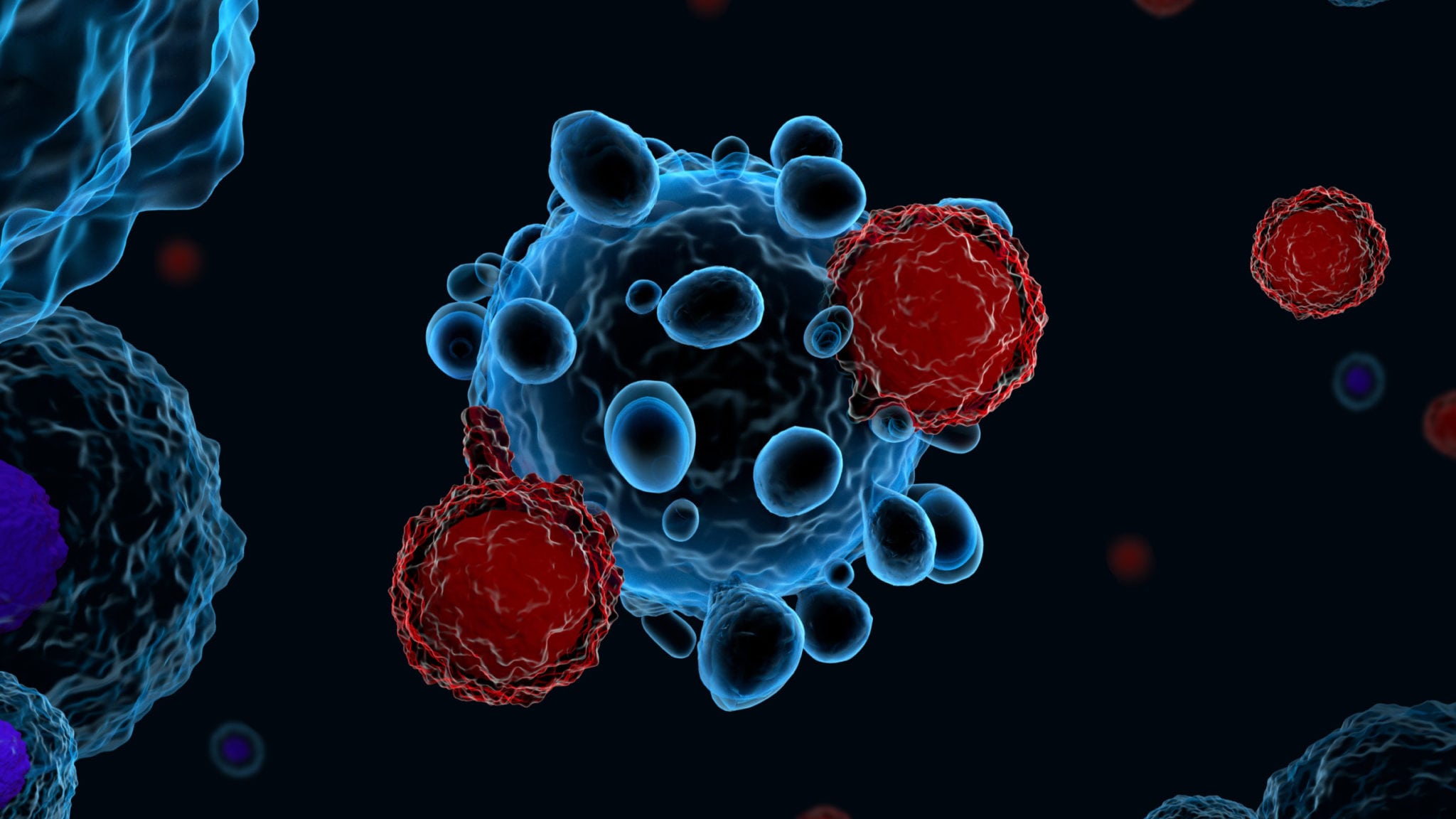

CAR-T therapies are engineered to work in this way: Cells are extracted from the patient and then manipulated in a lab where chimeric antigen receptors are added to direct the patient’s own T cells to snuff out specific cancer cells once re-infused back into the patient. But in a fraction of patients, the armed immune attack does not obliterate the disease. By targeting CD19, a marker present on almost all B cells, CAR-T therapies have shown remarkable potency and durability in a number of blood cancers, including acute lymphoblastic leukemia (ALL).

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.