Scynexis finds itself in the spotlight with a weapon that may fight a superbug that’s scaring the world to death

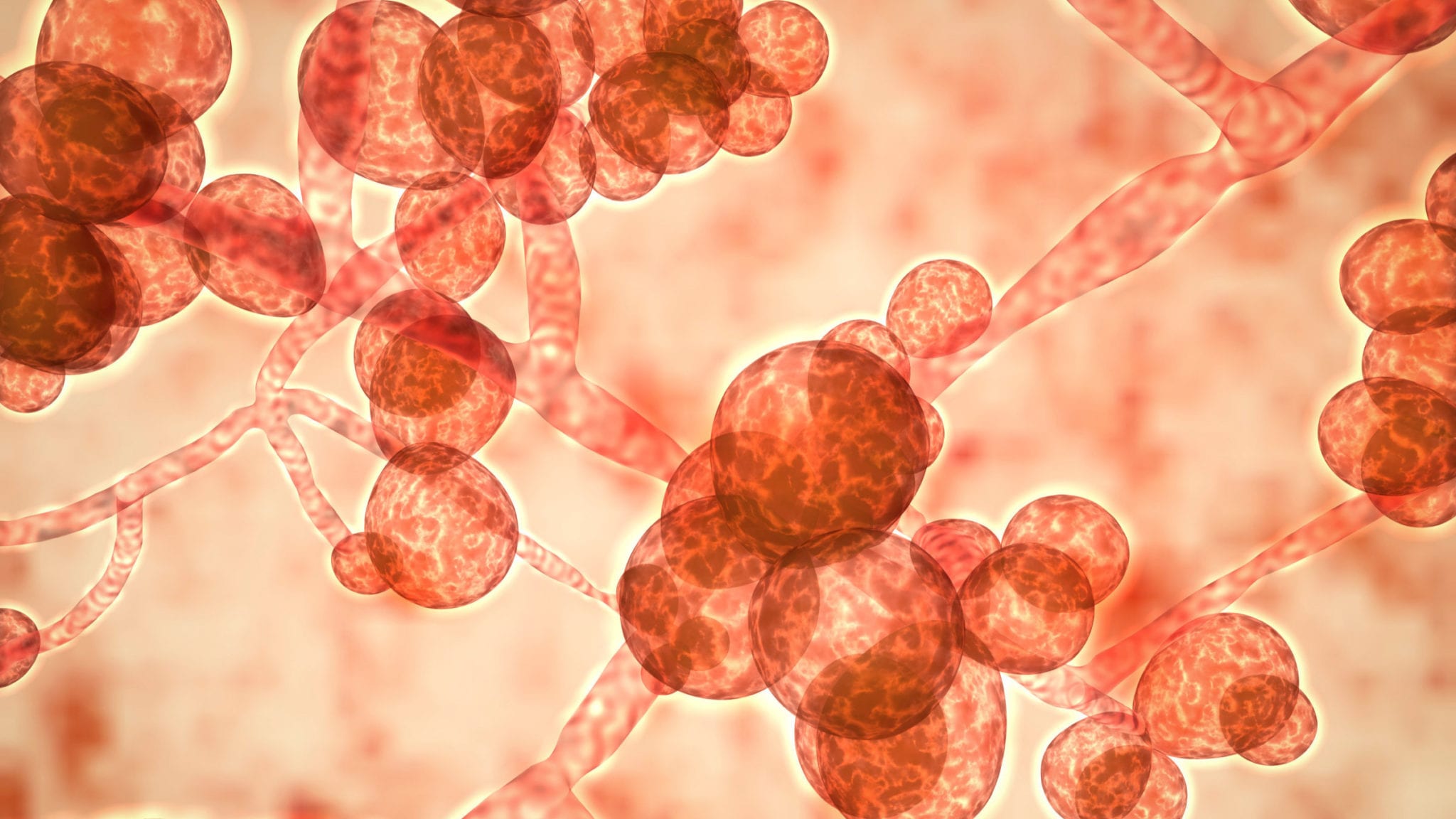

When Marco Taglietti flew from Amsterdam to Milan earlier this week, a neighboring passenger happened to ask what he did for a living. Upon learning he was an infectious disease specialist, the passenger inquired whether he had come across the recent report about this “difficult-to-treat new fungus.” Upon disembarking, Taglietti slid into his Uber, when his driver professed an interest in his profession. The physician’s answer produced a now-familiar response: Have you heard about Candida auris?

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.