What’s a biotech CEO worth? The top 15 pay packages puts a spotlight on performance — usually

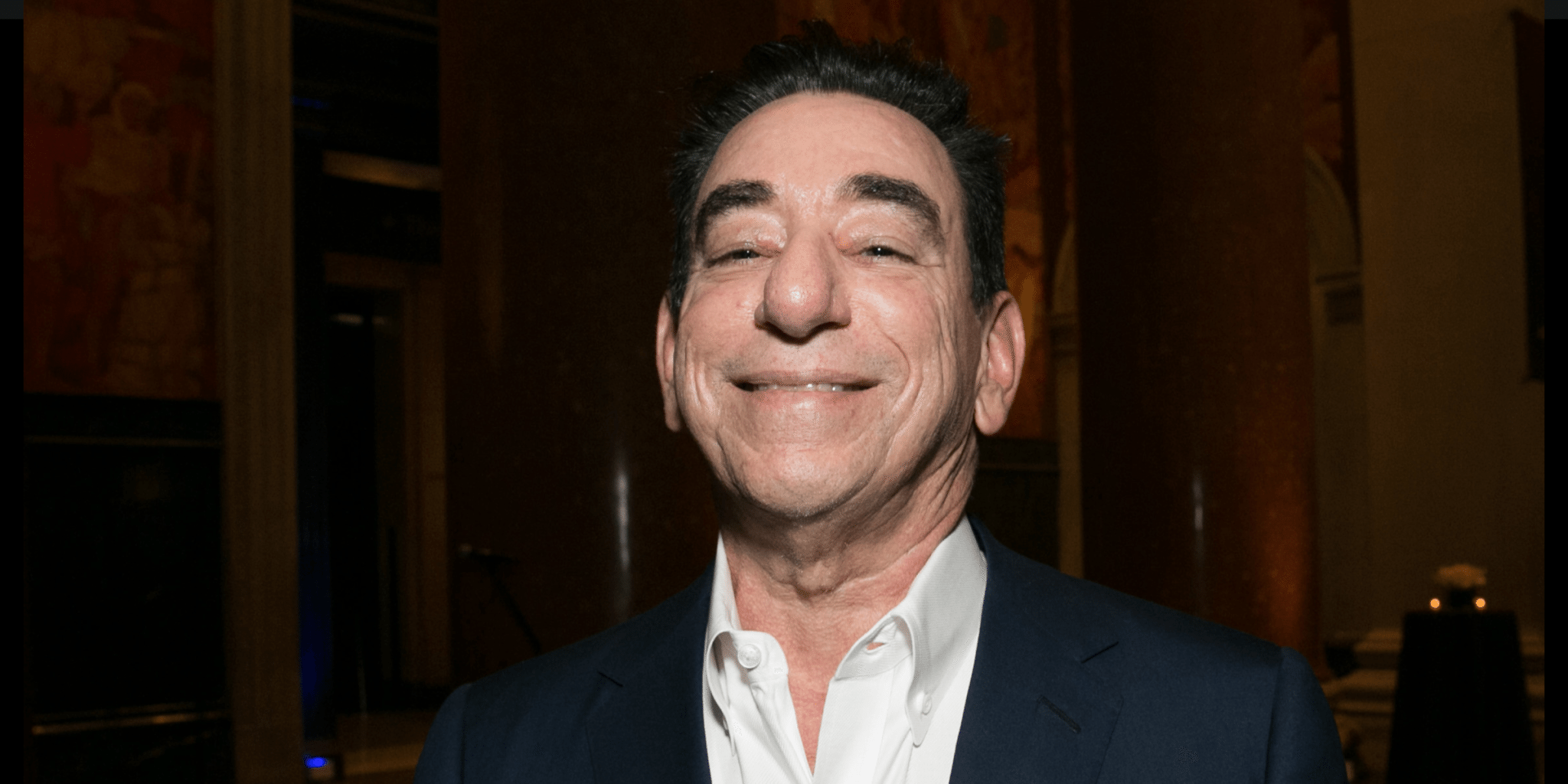

Regeneron CEO Leonard Schleifer attends Cold Spring Harbor Laboratory’s Double Helix Medals at the American Museum of Natural History on December 1, 2016.

Patrick McMullan/Getty Images

All biotech glory is fleeting. But the high pay can continue even after the plaudits and cheers are stilled.

Examining this year’s list of the 15 highest paid CEOs in biotech, you’ll find three ex-CEOs: Two who headed back to the biotech startup world, the other pushed out after a sales scandal. They all got one last year of compensation that dwarfs the payrolls of your average little biotech in search of fame and fortune.

A consummate dealmaker leads the list, followed by a self-made billionaire, but between the first and last you’ll see how compensation at this stage of the game is figured for your average high-profile enterprise. With a couple of glaring exceptions, they’re all gambling big on next-gen drugs, and several are under extreme pressure to start producing some solid results.

Of course, high expectations should go with high pay. You don’t get paid the big bucks for nothing. And none of these CEOs would be shy about explaining why they qualify for the top pay in the industry.

Typically, they all make less than the Big Pharma CEOs you’ll find at the very top of every compensation count down. People like J&J’s Alex Gorsky (2016 compensation $26.9 million) or Ken Frazier at Merck ($21.8 million) are on top with Ian Read ($17.3 million) and ex-Lilly CEO John Lechleiter ($18.3 million) coming in not far behind.

Hat tip to STAT, which helpfully pulled a lot of raw data on compensation. I weeded out a bunch of non-biotechs from that list, including all the generic players, and added background numbers on salary and compensation with some new commentary for each. I added Medivation to include David Hung’s compensation and dropped Jazz, which has yet to file a proxy this year.

Sign-in or subscribe now for instant access to this article.

(2,300 words remain)

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.