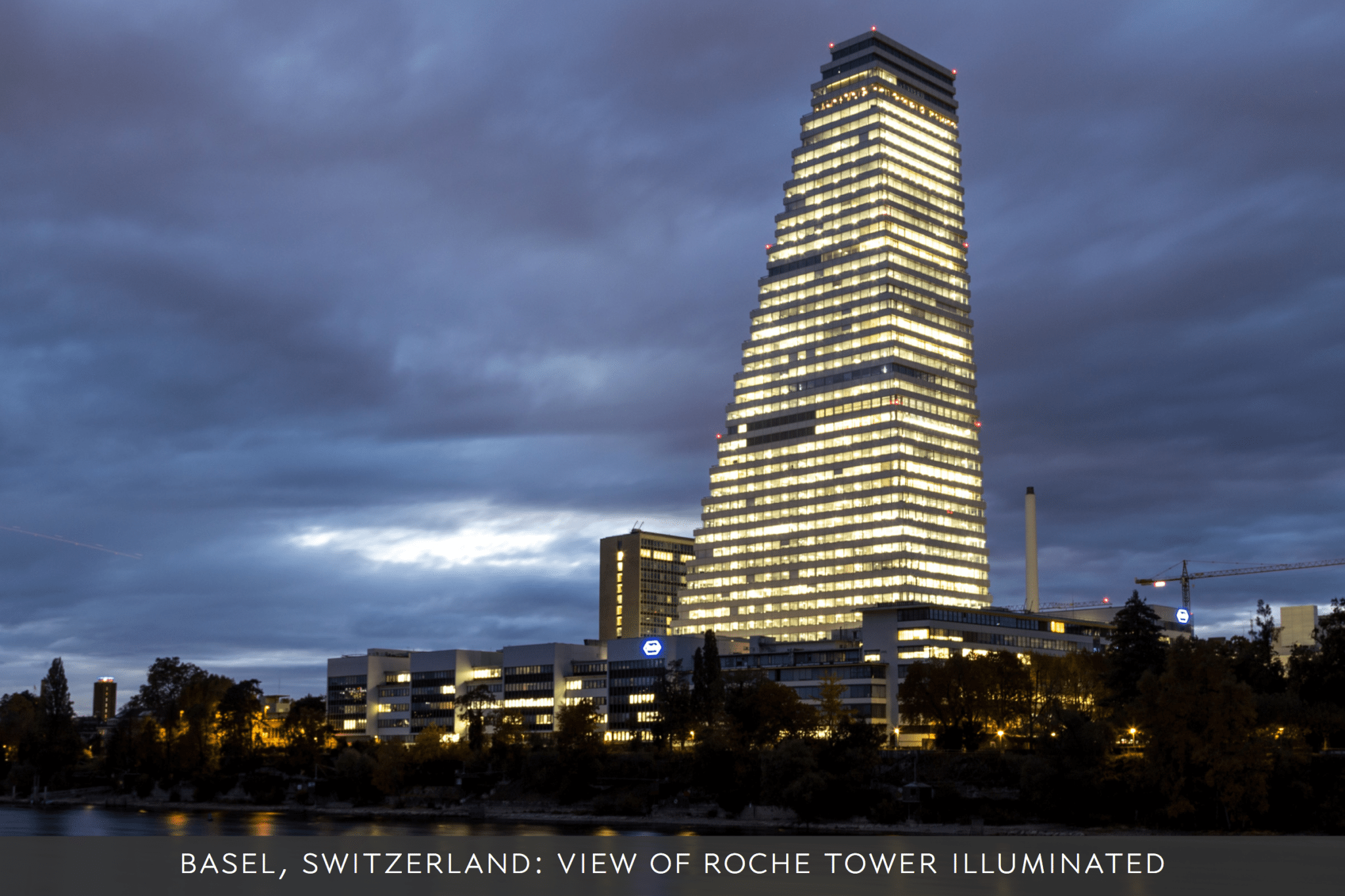

The biosimilar pack is growing around Roche’s all-star trio, looking to rip into a $21B franchise

Roche will get another reminder this week about just how important its late-stage pipeline is these days.

Thursday, the FDA’s committee of outside cancer experts will field a pair of applications for two new biosimilars of Avastin and Herceptin, two longtime drug franchises that last year provided about $14 billion in revenue to the Swiss pharma giant. And according to the FDA insiders who did the internal reviews, both of these copycats are ready to go.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.