The Broad wins another — perhaps final — battle in the war over Feng Zhang's CRISPR patents

Editas $EDIT and its rivals’ long running legal battle over the IP for the CRISPR/Cas9 tech used to edit genes may well be over.

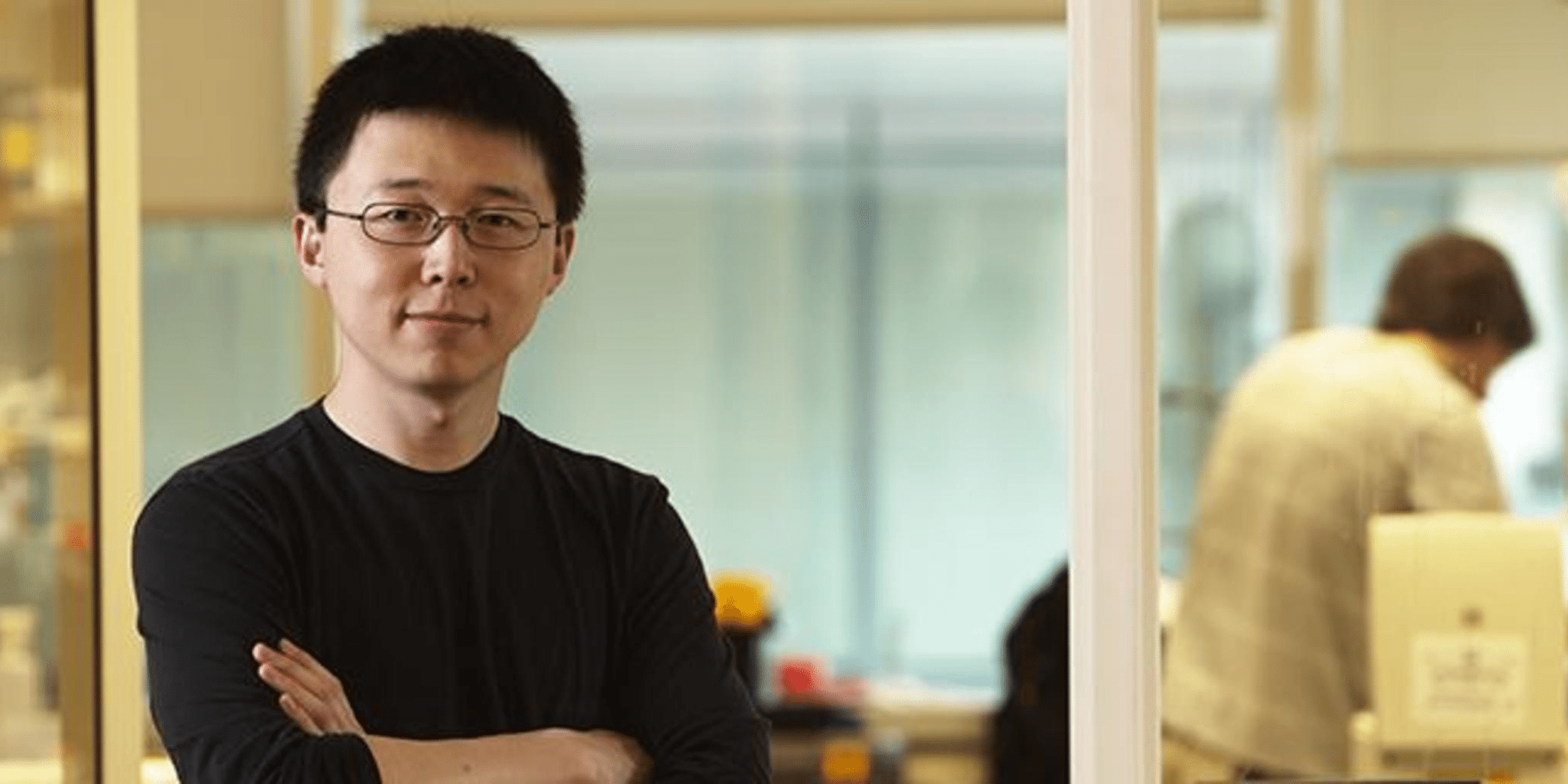

A federal appeals court has ruled in favor of the Broad Institute, confirming an earlier US patent board decision that their patents from the lab of investigator Feng Zhang did not “interfere” with the ones sought by UC.

And the judges came down so solidly in favor of the Broad that there’s likely little hope for any continuing appeals moves — though the UC system quickly put out a statement saying they’re still evaluating their options on litigating the issue.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.