The top 9 overseas accounts in biopharma hold $133B in M&A firepower

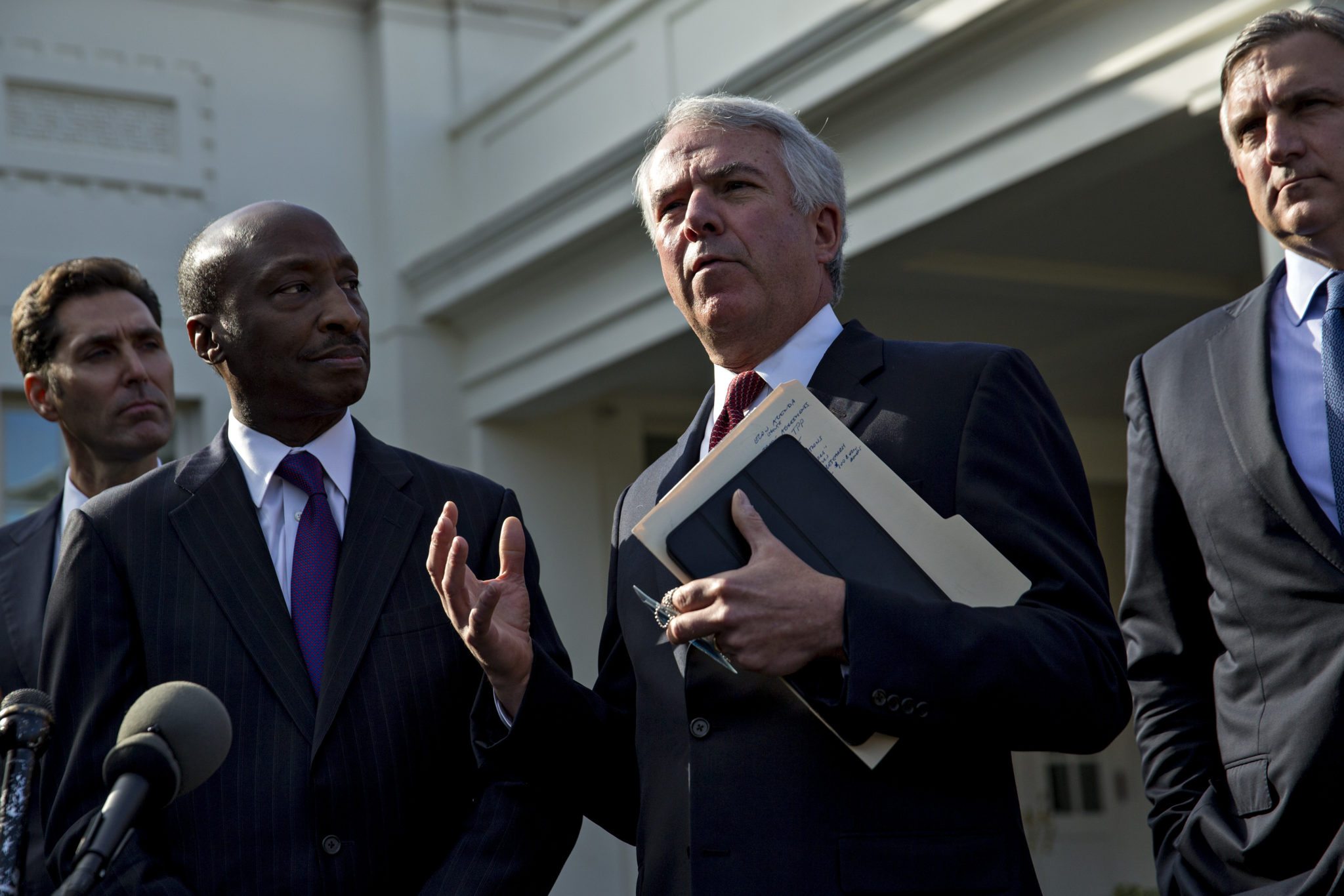

Pictured (L-R): Stephen Ubl, CEO PhRMA; Ken Frazier, CEO Merck; Robert Hugin, Celgene chairman; Robert Bradway, CEO Amgen on January 31, 2017 at the White House after meeting with President Trump. Andrew Harrer/Bloomberg via Getty

During Amgen’s Q1 discussion with analysts on Wednesday evening, CEO Bob Bradway repeated one of the key themes in the land of Big Biopharma. Biotech valuations are high, he noted, making it difficult to acquire the kind of drug assets he’d like to lay his hands on.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.