Tiny Innate reports a PhIIb disaster, battering shares — and a NY congressman

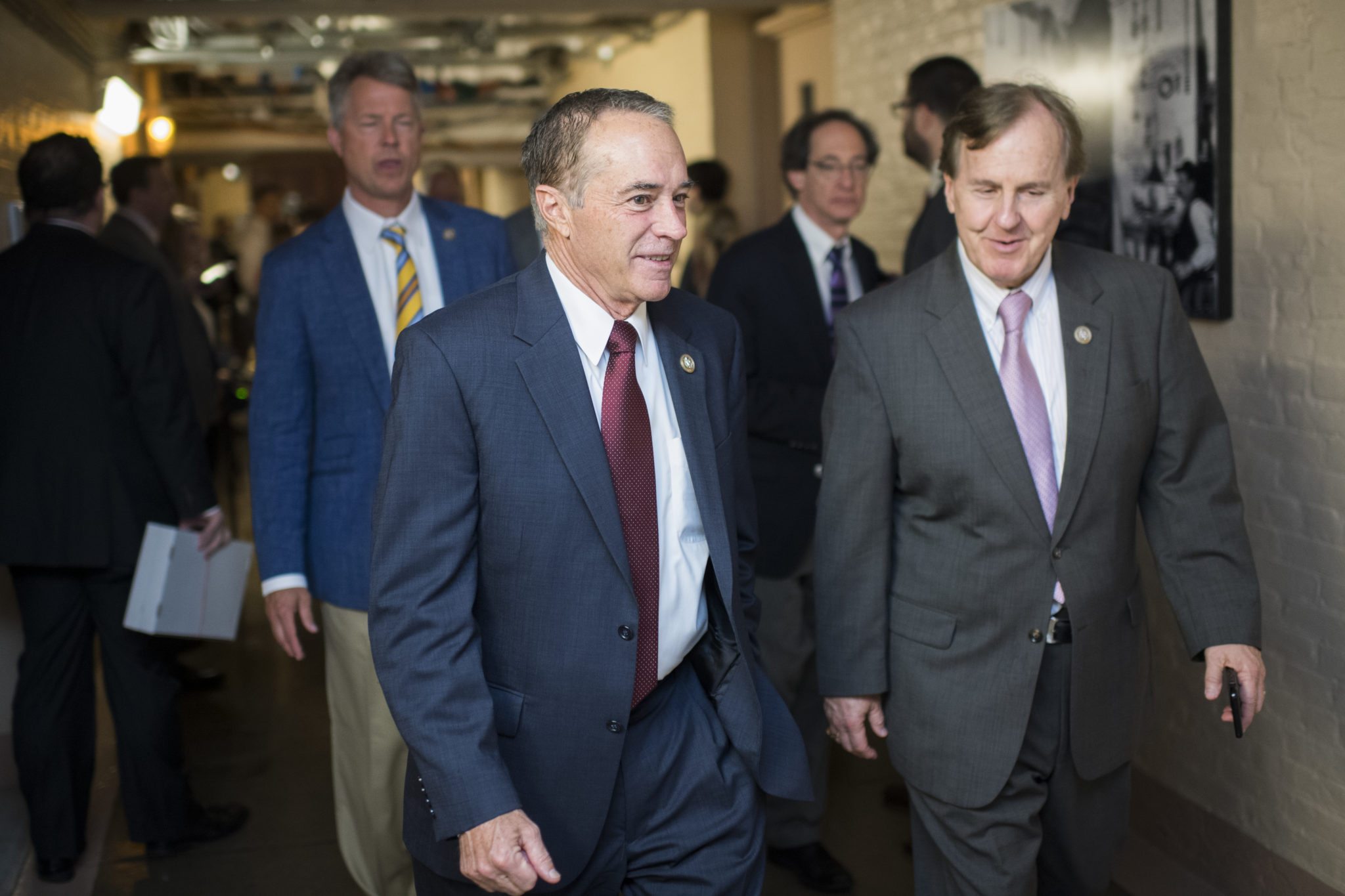

Reps. Chris Collins, R-NY, left, and Robert Pittenger, R-NC, leave a meeting of the House Republican Conference in the Capitol on June 7, 2017. CQ Roll Call

Just about everything the little Australian biotech Innate Immunotherapeutics tracked in its Phase IIb study of its experimental drug for multiple sclerosis points to a disaster. The data on all 93 patients in the study demonstrate a clear failure of the drug to deliver an improvement for patients on any of “multiple” endpoints. The dropout rate in the drug arm was high. And the rate of serious adverse events was higher in the drug arm than in the control group.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.