Under siege, investment manager Woodford faces another investment shock

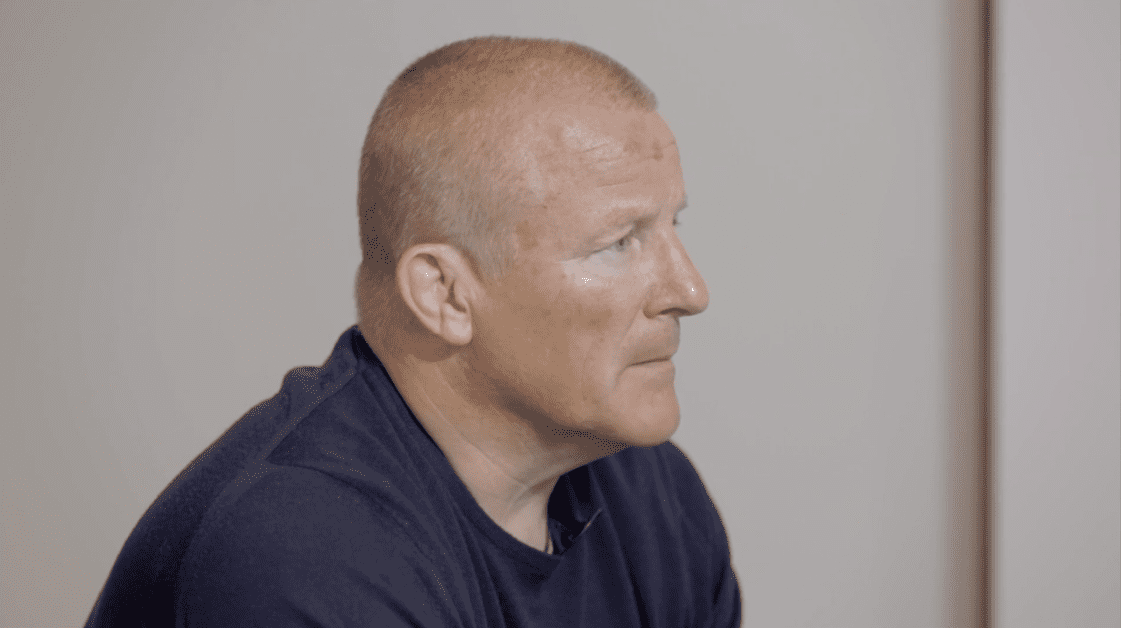

Embattled UK fund manager Neil Woodford — who has controversially blocked investors from pulling out from his flagship fund to stem the bloodletting, after a slew of disappointed investors fled following a series of sour bets — is now paying the price for his actions via an investor exodus on another fund.

Hargreaves Lansdown, which has in the past sold and promoted the Woodford funds via its retail investment platform, has reportedly withdrawn £45 million — its entire position — from the investment manager’s Income Focus Fund.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.