Vertex is reorganizing and consolidating R&D, shuttering a site in Canada

Vertex has pulled out the ax in a move to chop down the size of its R&D operation.

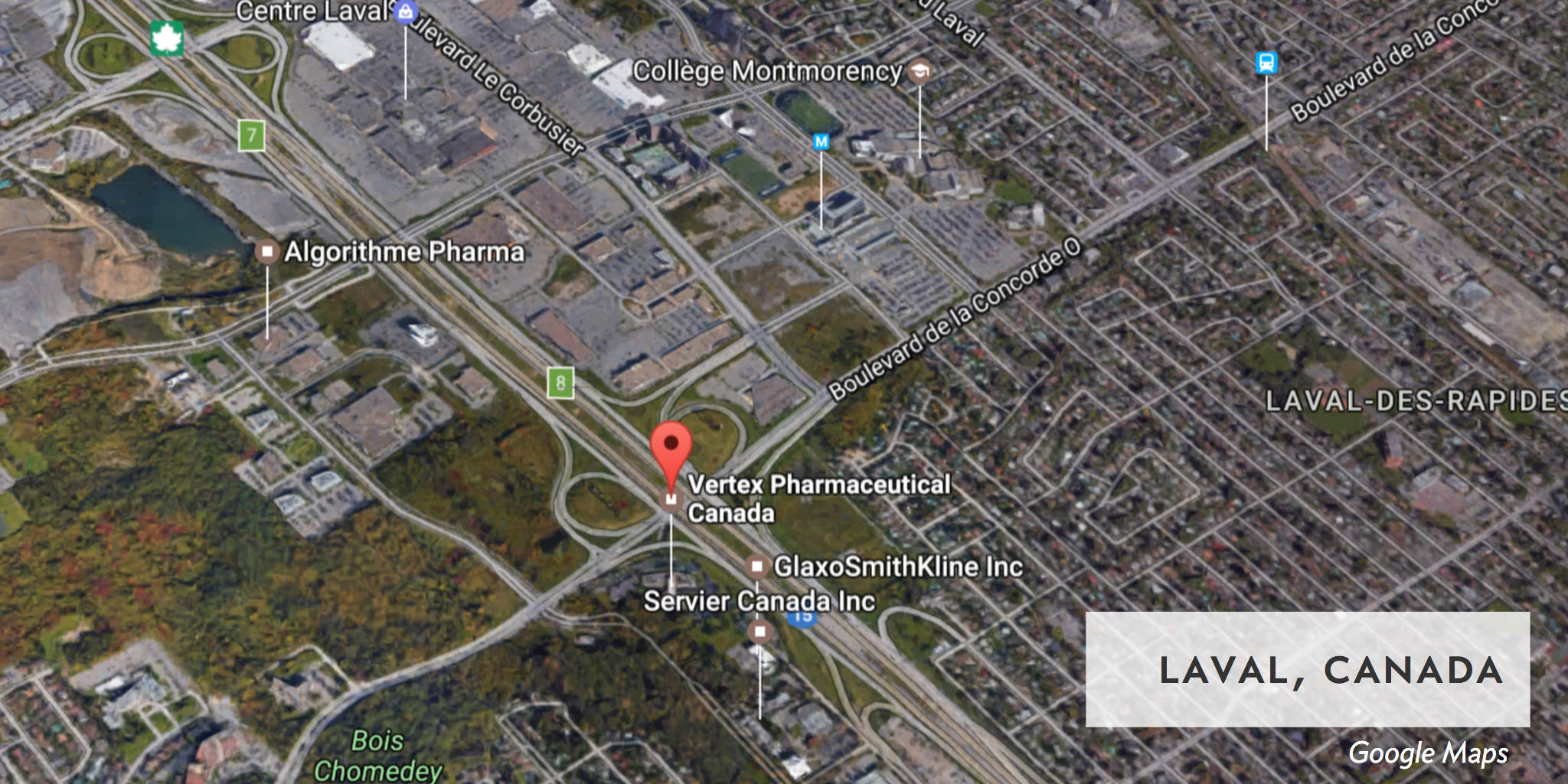

The big biotech noted in its 10-K that the company decided last month to shutter a research site in Canada while “consolidating” R&D in three locations scattered across the country. And company sources tell me that there have been a number of recent cuts as well in the hometown R&D group in Boston stretching back over the past year.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.