Genetic Medicine Leads a Surge of Innovation in Biotech

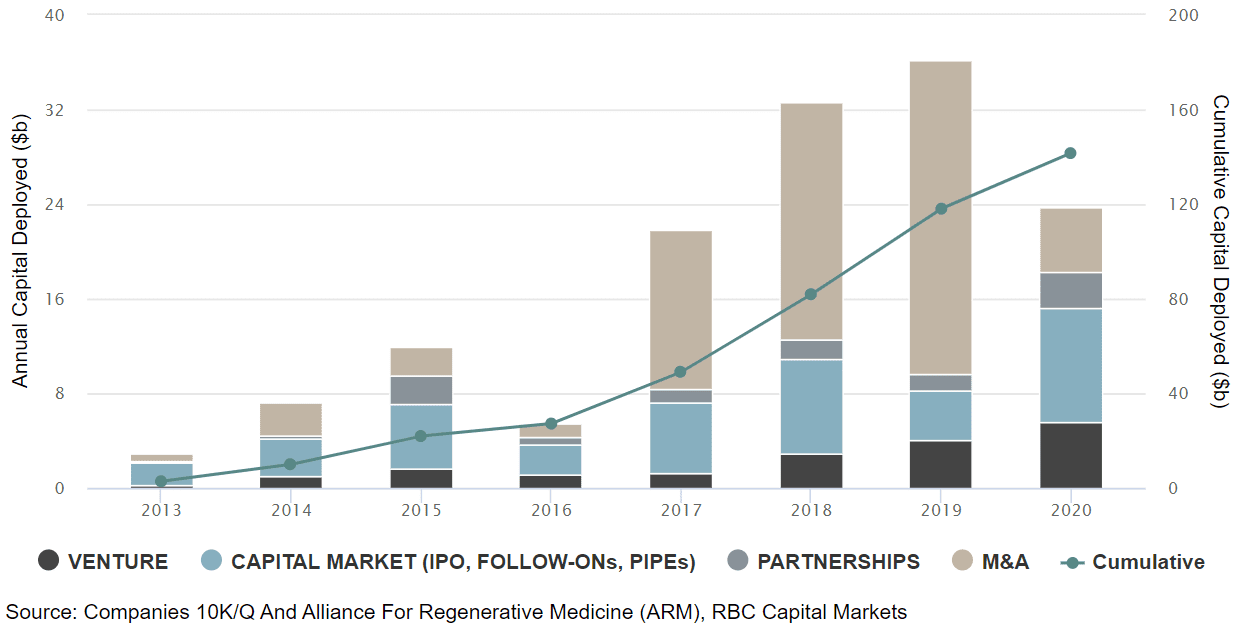

Genetic medicine, the delivery of genetic material as a therapeutic, has attracted record-breaking capital in biotech with ~$150 billion invested across ventures, IPOs, follow-ons, and M&A since 2013.

This influx of capital, combined with some critical scientific breakthroughs, has led to the approval of multiple drugs that are changing the lives of patients worldwide. We think this could be just the tip of the iceberg given that there are more than 1,000 clinical trials underway, preclinical companies are raising record-breaking capital and multiple academic labs are working on the latest iteration of the technology. Importantly, while the first few drugs were approved for rare diseases (such as spinal muscular atrophy, inherited retinal diseases, familial hypertriglyceridemia), we now have two COVID19 vaccines approved (mRNA based) and multiple drugs poised to be approved for more prevalent diseases in cardiology, neurology, oncology, and autoimmunity. Outside of COVID19, which is expected to generate $50b+ in revenue this year, we expect genetic medicine to top $20b in revenue by 2026.

Gene Editing is the New Frontier

Gene editing has quickly emerged as one of the most promising approaches within genetic medicine as highlighted by the 2020 Nobel Prize in Chemistry awarded to Emmanuelle Charpentier and Jennifer A. Doudna for their pioneering work of CRISPR-Cas9.

This technology, which involves deletion, insertion or correction of DNA, enables scientists to precisely tackle the genetic root cause of the disease. Such an approach can be “one-and-done” and avoid the chronicity of the current standard of care. Rapid advancements in this field are creating a robust product pipeline and attracting record amounts of capital. We estimate $14 billion deployed since 2015 and $43 billion in cumulative market capitalization. Importantly, all this capital is translating into benefits for patients as recently shown by the NTLA’s tantalizing clinical data for TTR-polyneuropathy earlier this summer.

In Vivo Gene Editing Likely The Future As Highlighted By Recent Data

There are two different types of gene editing:

- Ex vivo is logistically complex and requires taking cells from the patient, genetically manipulating them in the lab, and re-infusing them back after patients have received a toxic preconditioning regimen like chemotherapy.

- In vivo is a much easier approach where cells are edited directly inside the patient. A delivery vehicle is often used to target a specific organ/cells but the route of administration is usually a simple IV infusion. Unlike ex vivo, there is no need for toxic preconditioning (albeit, a short course of prophylactic steroids is usually required) and the simpler logistics substantially reduce turnaround times.

While most patients today have been “gene edited” using an ex vivo approach, in vivo gene editing is likely the future. The very first in vivo CRISPR-based gene editing clinical data was released in June, and it looked promising with no serious adverse events, impressive biomarker reductions, and evidence of dose response. It is early days, but the future of in vivo gene editing is off to a great start as the news has unlocked ~$10 billion in value for gene-editing, and suggests this one-and-done therapy may beat current therapies on both efficacy and convenience.

Investors Need To Weigh The Promise Of Gene Editing Against Potential Safety/Regulatory Risks

Based on promising pre-clinical data and the backing of blue chip biotech investors, we think the anticipated debut of early-stage biotech companies offering newer gene editing capabilities (such as base/prime editing) will provide further momentum to the IPO market this year. Looking to the future, and despite all the enthusiasm around gene editing, we believe companies will need to tread cautiously with this technology. Gene editing can’t be reversed and we don’t fully understand its long-term implications and potential for on-target and off-target toxicities. Until more clinical studies play out, investors need to weigh the promise of gene editing against potential safety and regulatory risks. Therefore, we believe the ultimate “winners” in this field may not necessarily be the companies with the most attention-grabbing technology, but those that can successfully target the right indications and cleverly design clinical trials.

Gain perspectives from the cutting edge of biotech to help you lead today and define tomorrow. Explore RBC’s Pathfinders in Biopharma series.