A Winding Road Ahead for Biotech?

The biotech sector has evolved significantly over the last five years, but innovation continues to drive investor optimism. However, with patent cliffs looming, biosimilar competition heating up, easing concerns around the FTC, and IRA uncertainty on the horizon, the path to sector outperformance has a winding road ahead. RBC Capital Markets’ Biotech Halftime Report explores the headwinds and tailwinds shaping biotech’s future moving into 2024.

Key Points:

- Strong innovation into new modalities such as emerging antibody constructs and genetic medicine are generating widespread enthusiasm across the sector

- Looming patent cliffs and drug development reforms are causing biopharma companies to shift strategies

- While biotech is under pressure, the S&P Biotech index (XBI) is showing early signs of stabilization

Strong innovation in biopharma

Innovation continues to be a hallmark of the biotech sector. New modalities, from emerging antibody constructs to genetic medicines, have flourished and enabled increased target interrogation. Further exploration and utilization of these modalities is likely to be a key factor for biopharma growth in the coming years.

Once-dormant spaces of medicine are also experiencing enthusiastic attention from biopharma. Metabolic diseases, for instance, have undergone a treatment revolution, as both small and large players look to take on and potentially reform diabetes and obesity therapeutics. There has been a shift from contemporary single-receptor agonism to bispecifics, which indicates that the industry is looking to target weight loss as well as glycemic control. Clinical management remains top of mind as real-world tolerability is brought into question; adverse events are impacting quality of life and serve as a clear gating factor to substantial market opportunity.

Alzheimer’s, immunology and inflammatory diseases have similarly seen a wealth of development focus, which is putting a positive light on the industry as a whole.

With U.S. drug approvals and accelerated approvals on the rise, the FDA is demonstrating an increasing flexibility for earlier approvals in unmet need diseases.

Biotech innovation not without setbacks

As new modalities and diseases take center stage, corresponding considerations have arisen, largely around manufacturing, safety, and treatment protocols.

In the manufacturing arena, challenges with the scalability of some products, particularly for CAR-T, gene therapy, and radiopharmaceuticals remain. Biotech production is inherently complex, and further exacerbated due to limited capacity and bandwidth.

Developmental therapies are being explored with novel modalities and targets; this is yet another risk to consider, especially with the FDA expediting approvals.

Treatment protocols are also being more closely examined. Many novel drugs entering the market are short course or one-time therapies; this presents a complicated commercial challenge that will need to be addressed given its significant implications for revenue opportunities.

The unintended consequences of the Inflation Reduction Act (IRA)

The long-term effect of the drug pricing provisions in the IRA could have a detrimental effect on the industry at large. Beyond the obvious financial burden, the IRA will also impact drug development and the initiation of new products. The shortened exclusivity lifespan of small molecule drugs and biologics has companies questioning whether drug development in certain spaces may be as worthwhile.

However, key legal and regulatory developments may begin to ease concerns around IRA overhangs in 2024. Larger players and industry groups have taken legal action against CMS drug price negotiations, noting specifically the impact this legislation could have on innovation in drug development and long-term value. Challenging the IRA is likely an uphill battle that could prompt Congressional retaliation, but preliminary injunctions could delay IRA implementation enough to have a positive effect on perceived revenue tails and stocks.

Facing a patent cliff

Several blockbuster drugs are losing exclusivity soon, which will result in revenue hits to their corresponding pharma companies. Histological trends indicate that around 70% of market erosion is likely within the first 4-5 years of biosimilar entry. New and updated policies underscore the latest regulatory and legislative push to facilitate biosimilar product development and subsequent adoption. This support may facilitate a quicker and larger market uptake for future generic products.

Competition in biopharma

Multiple companies are operating in overlapping therapeutic areas and often pursuing similar modalities. Biotechs will have to examine their capital allocation and narrow in on innovative and differentiated approaches. Out-year estimates often fail to take into account future competition, pricing in too much growth given the circumstances.

While competition in the biotech space remains problematic, there are some benefits. Data from competitors could serve as a positive catalyst in understudied areas where mechanisms are less validated, and highly competitive environments may encourage M&A as companies consolidate. Having multiple effective drugs for a given indication could be useful down the line for novel combinations, or determining lines of therapy.

M&A: In the shadow of the FTC lawsuit

The FTC’s unexpected lawsuit to block Amgen’s acquisition of Horizon Therapeutics has had a noticeable chilling effect on the M&A space. Furthermore, the lack of visibility into broader macro trends around market volatility and cost of capital is serving as a deterrent to M&A activity. The perceived “safer” option is engaging in collaborative deals — it mitigates risk while simultaneously supporting growth and innovation.

Biotech under pressure

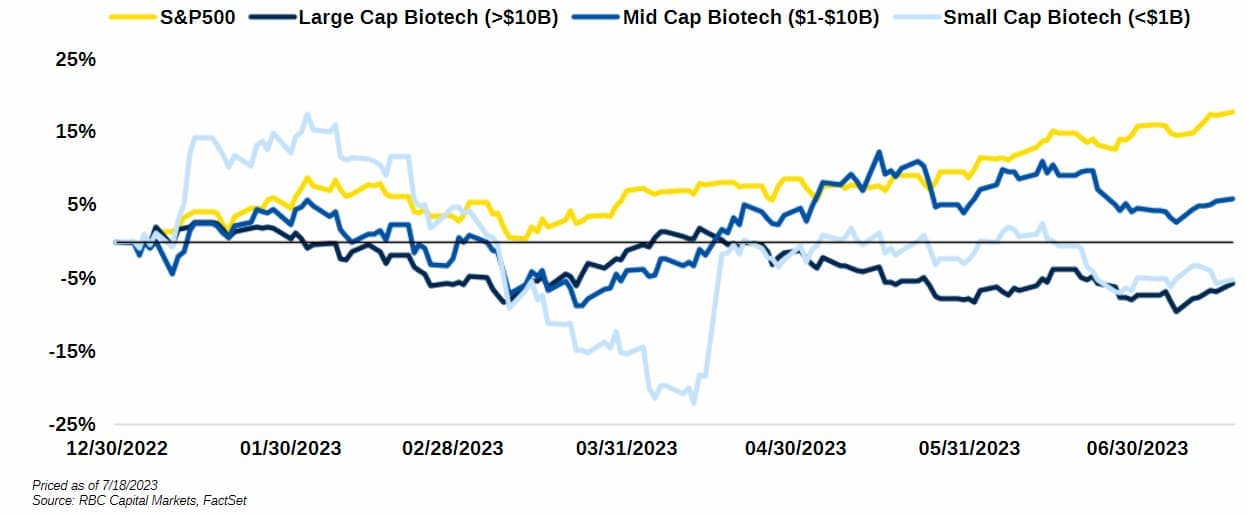

Recessionary fears are fueling a risk-off environment, which is further exacerbated by headwinds, including the expected loss of COVID treatment revenue, patent cliffs, FTC deal scrutiny, and the IRA. All of these place pressure on biotech as a whole.

However, historical data suggests that biotech is able to withstand both recessionary and inflationary pressures; given their growth profile, they tend to recover faster than the S&P500. With inflation abating and a soft landing looking more probable than a full recession, biotech is expected to grow into any economic turnaround.

Biotech markets are indicating early signs of stabilization, with the XBI hovering around early-year levels. In 2023, the IPO market has remained unmoved, but there is potential for companies with clinical assets to go public as private funding has cooled off.

Investor sentiment in the second half of 2023 is positive, with investors surveyed by RBC Capital Markets’ expecting biotech to outperform the broader market.

“With U.S. drug approvals and accelerated approvals on the rise, the FDA is demonstrating an increasing flexibility for earlier approvals in unmet need diseases.” – Brian Abrahams, M.D., Head of Biotechnology Research, RBC Capital Markets

Gain perspectives from the cutting edge of biotech to help you lead today and define tomorrow. Explore RBC’s Pathfinders in Biopharma series.