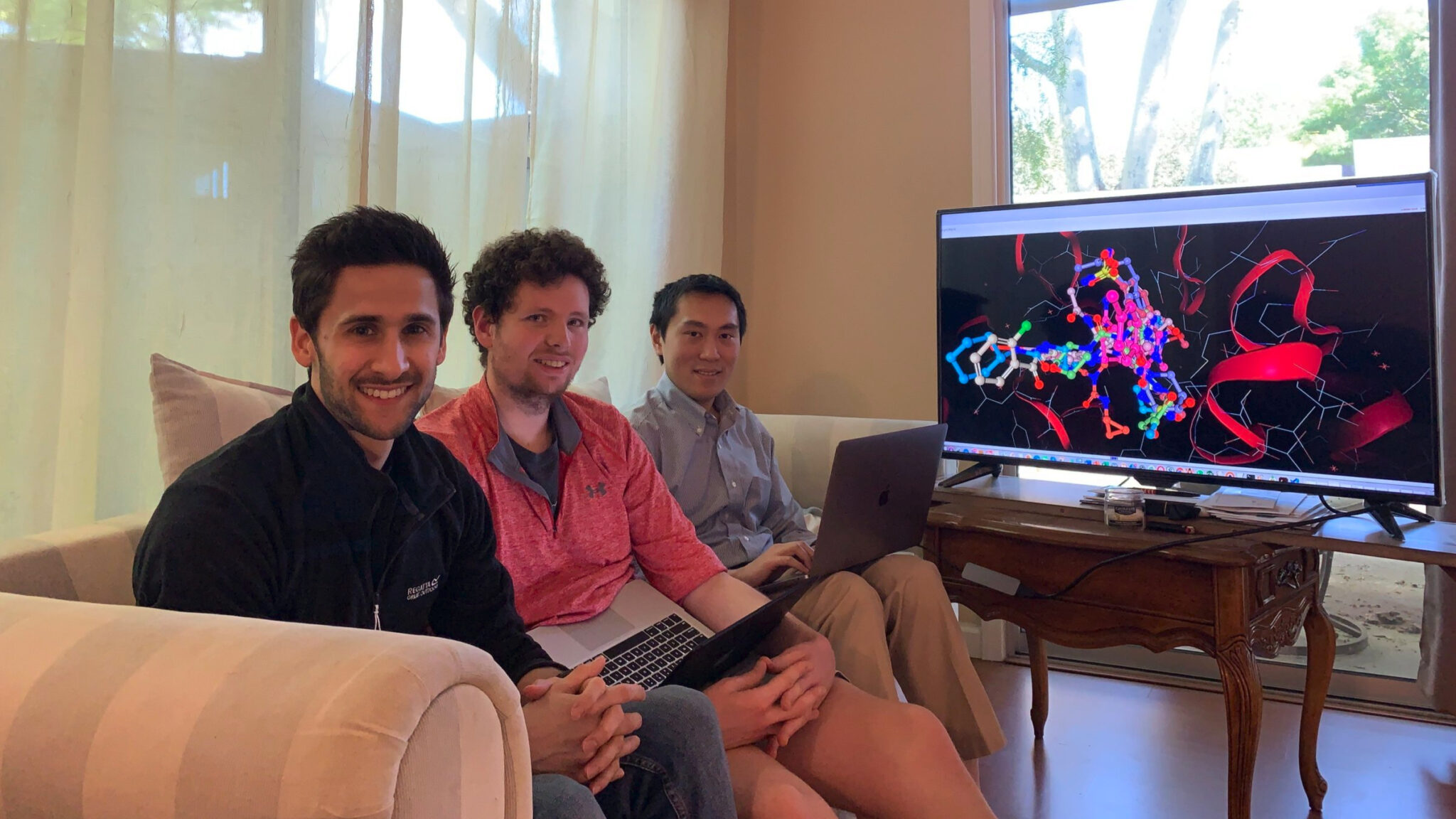

From L-R: Aaron Morris, Matt Robinson and Alpha Lee (PostEra)

A new AI startup has emerged, and Pfizer likes what it sees

Aaron Morris and Alpha Lee met years ago while studying applied mathematics at Oxford University. They eventually went their separate ways, with Morris diving into …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.