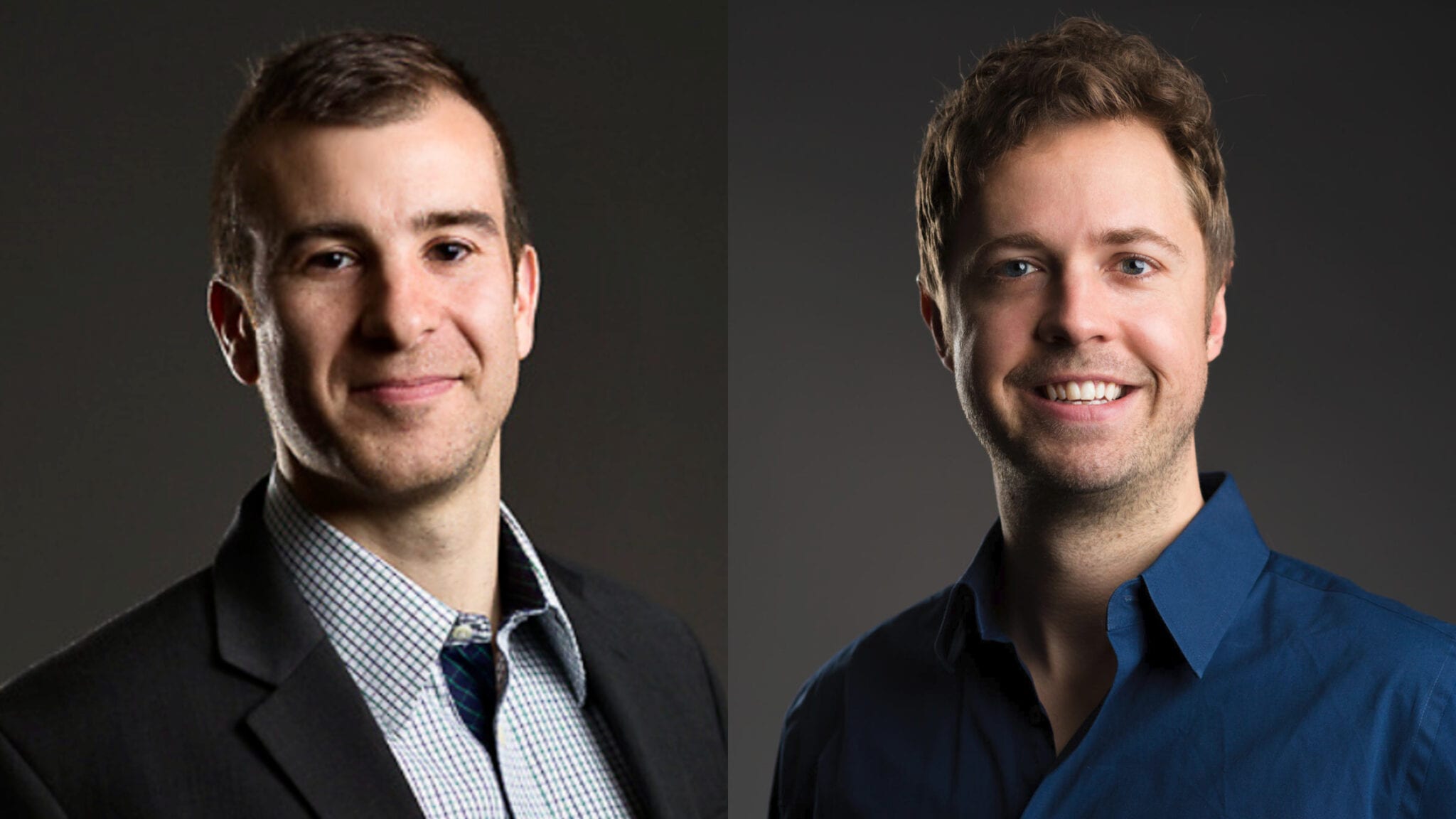

Marc Lajoie (L) and Scott Boyken (Outpace Bio)

A pair of Lyell founders look to shift the cell therapy paradigm — and they've got $30M to get their plan off the ground

Rick Klausner’s Lyell has taken the cell therapy field by storm, recruiting an All-Star team with the goal of creating the first CAR-Ts for solid …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.