A transpacific biotech startup combines Asian investors and some seriously trendy science out of MIT

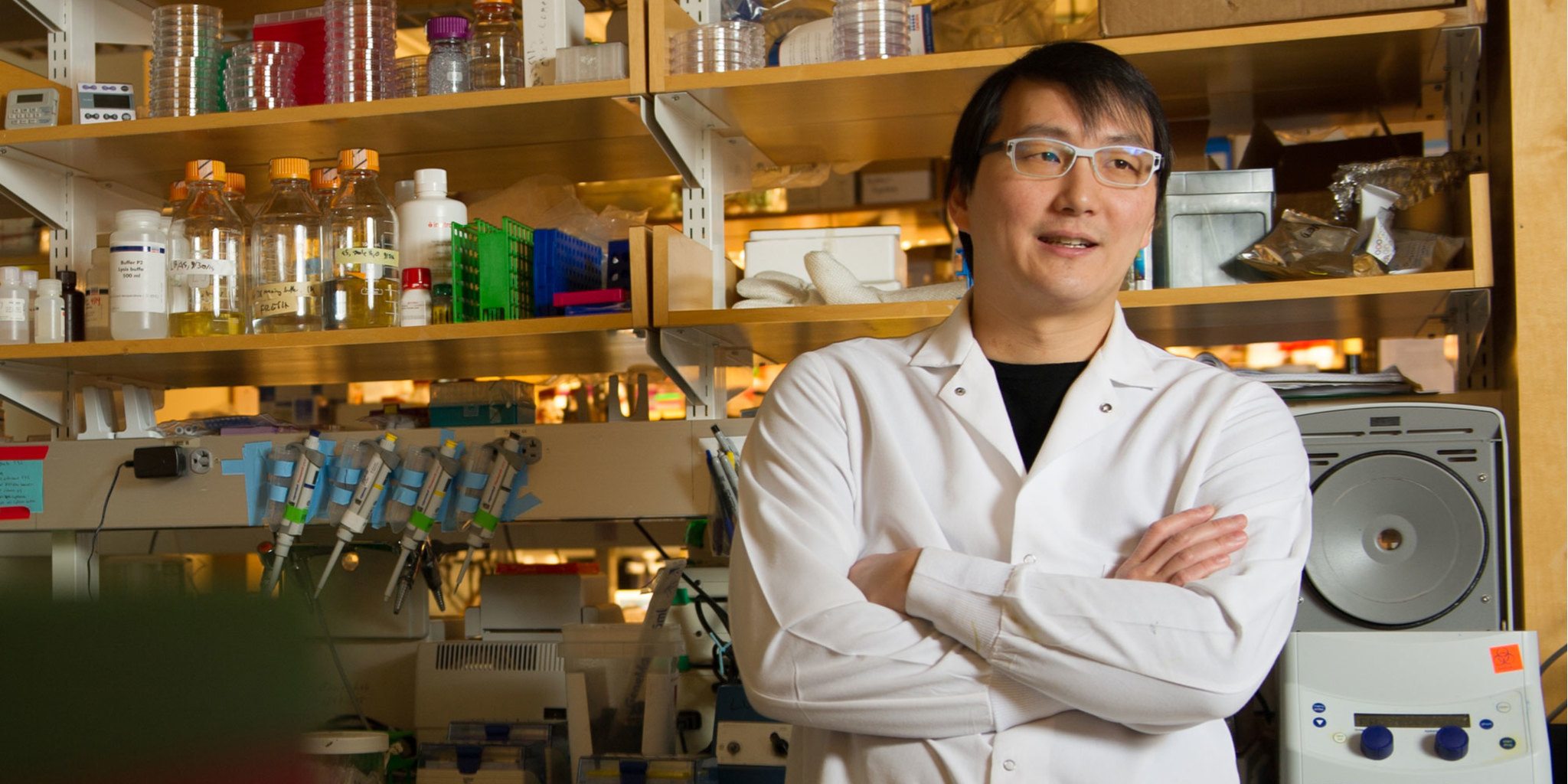

Synthetic biologist Timothy Lu has been doing some mind blowing scientific work at MIT. A few months ago he and some of his colleagues wrote …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.