Marathon's cheap, old steroid breezes through the FDA for Duchenne MD, and gets priced at $89K

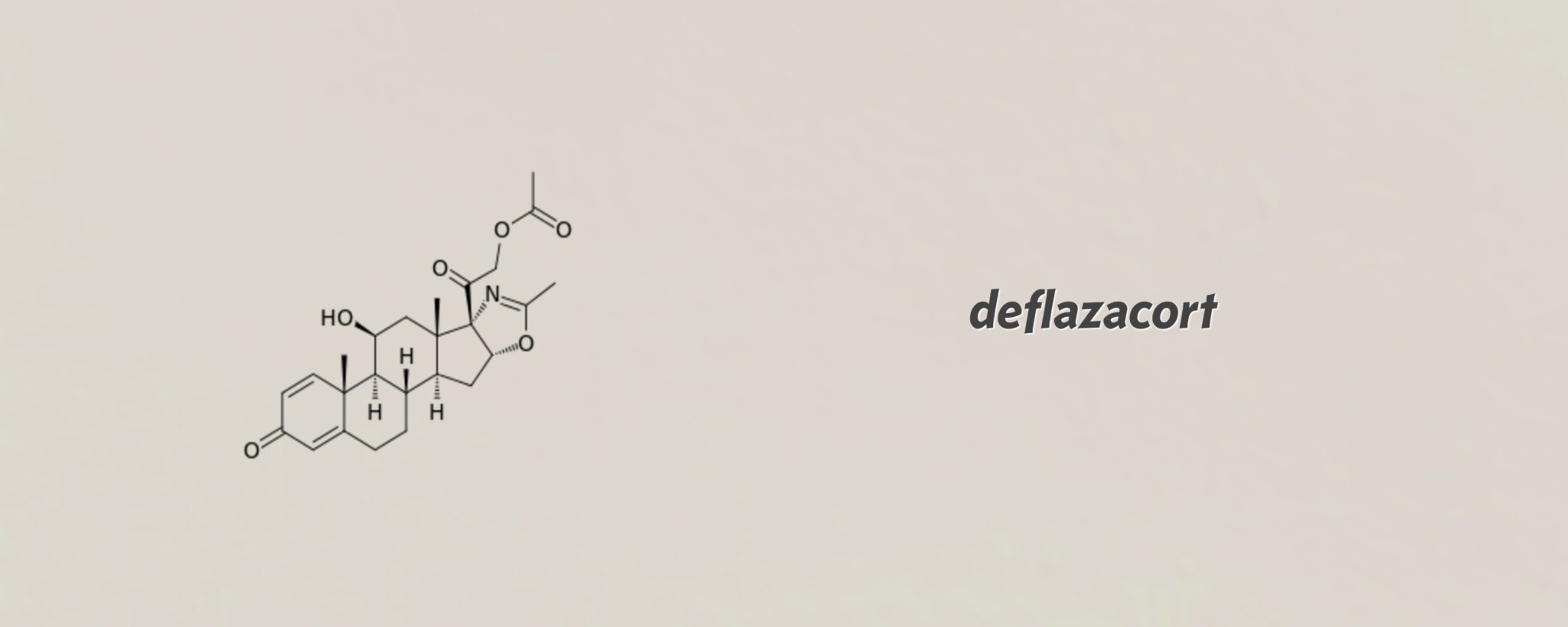

For a simple systemic steroid that is cheap and easily available outside the US, deflazacort has received unusually careful support from the FDA, breezing through …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.