An update on the Endpoints business model — and how your company can directly support it

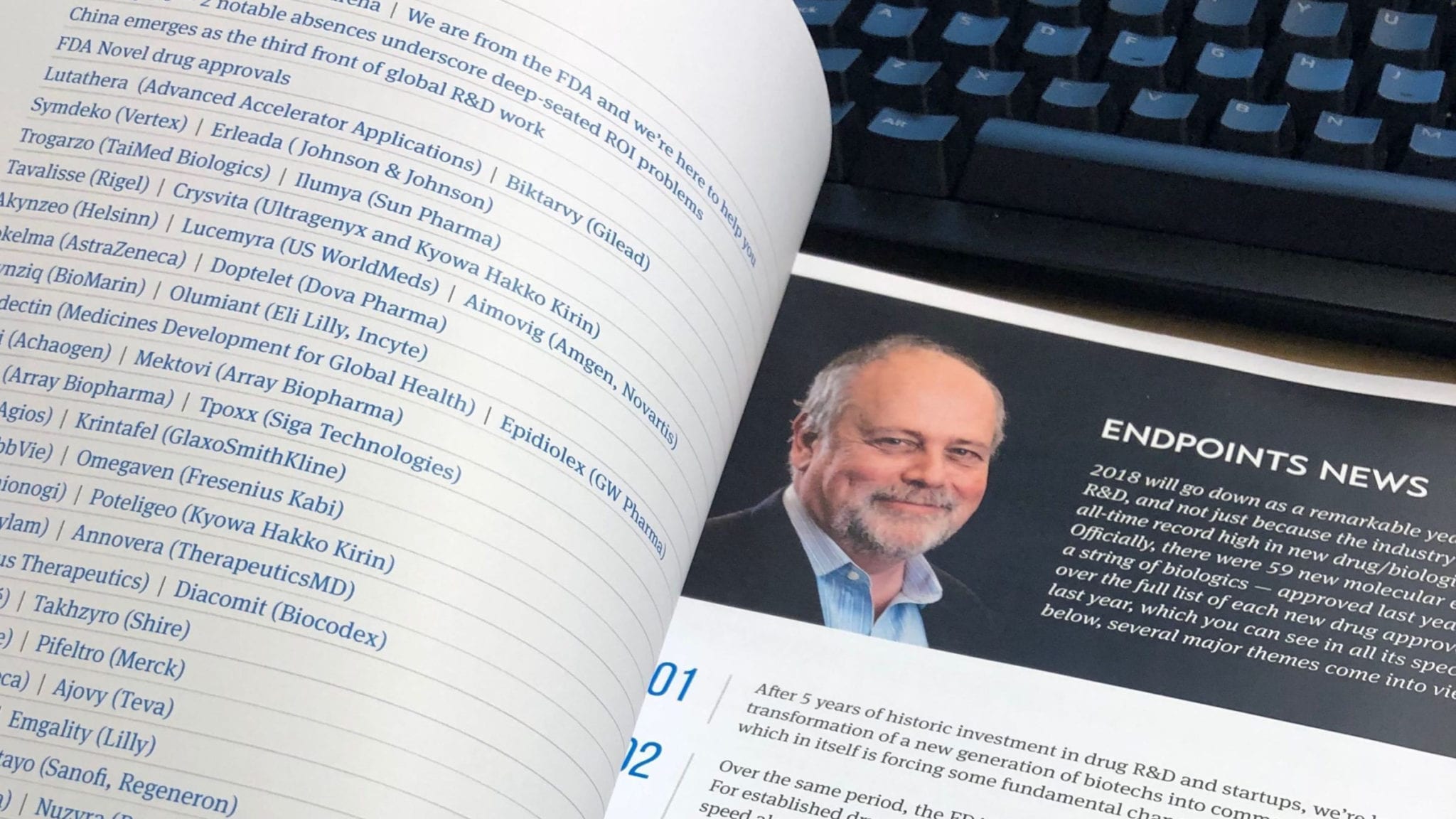

Pictured: The print-optimized version of Endpoints’ 2018 New Drug Approvals report. All paid subscribers will receive a direct link to download the PDF + a copy …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.