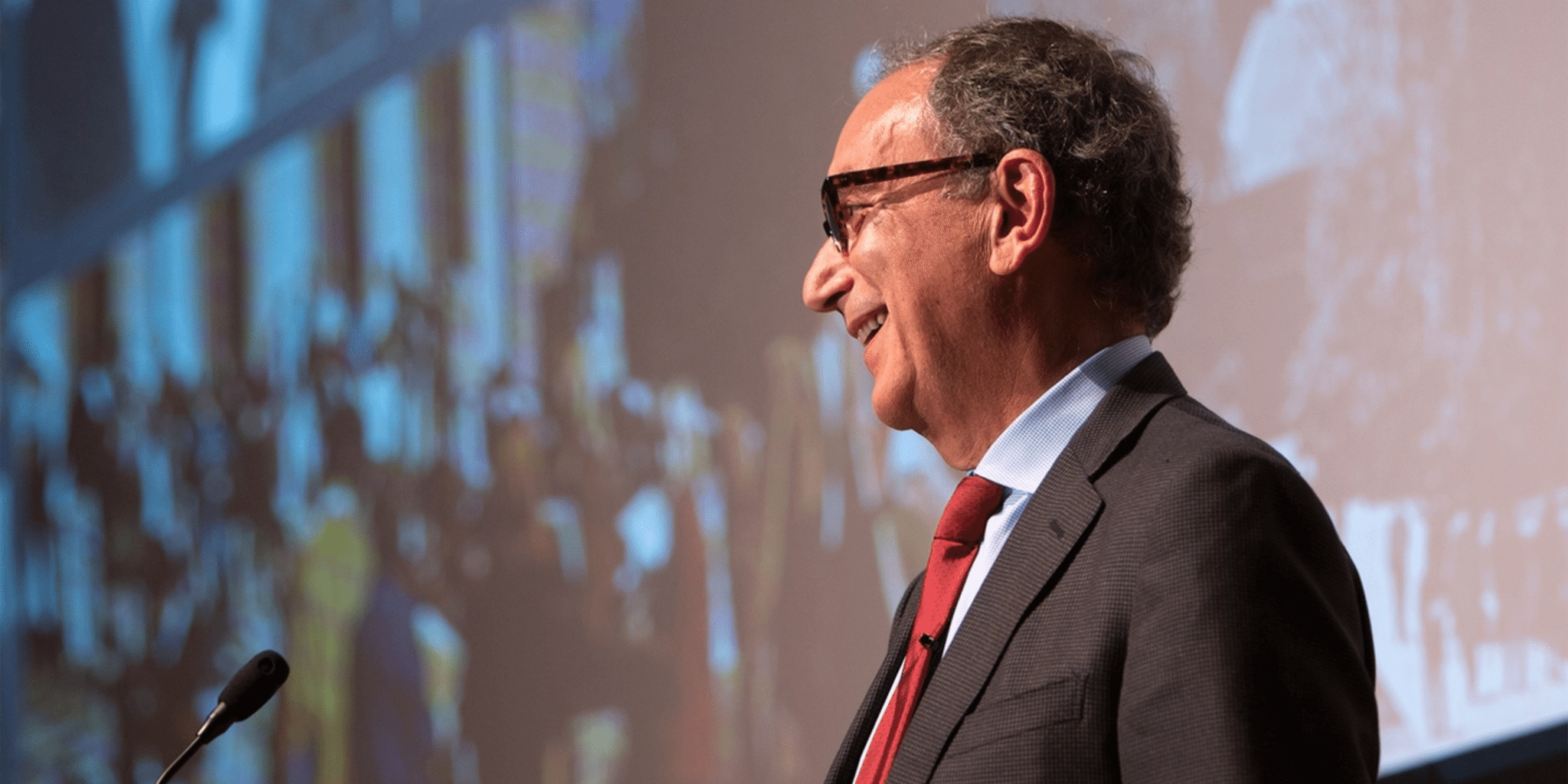

George Scangos / Credit: Cornell University

ARCH, SoftBank-backed Vir Biotechnology underwhelms with $143 million IPO

George Scangos went back to Wall Street, and came back 700 million pennies short.

Scangos’ vaunted startup Vir Biotechnology raised $143 million in an …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.