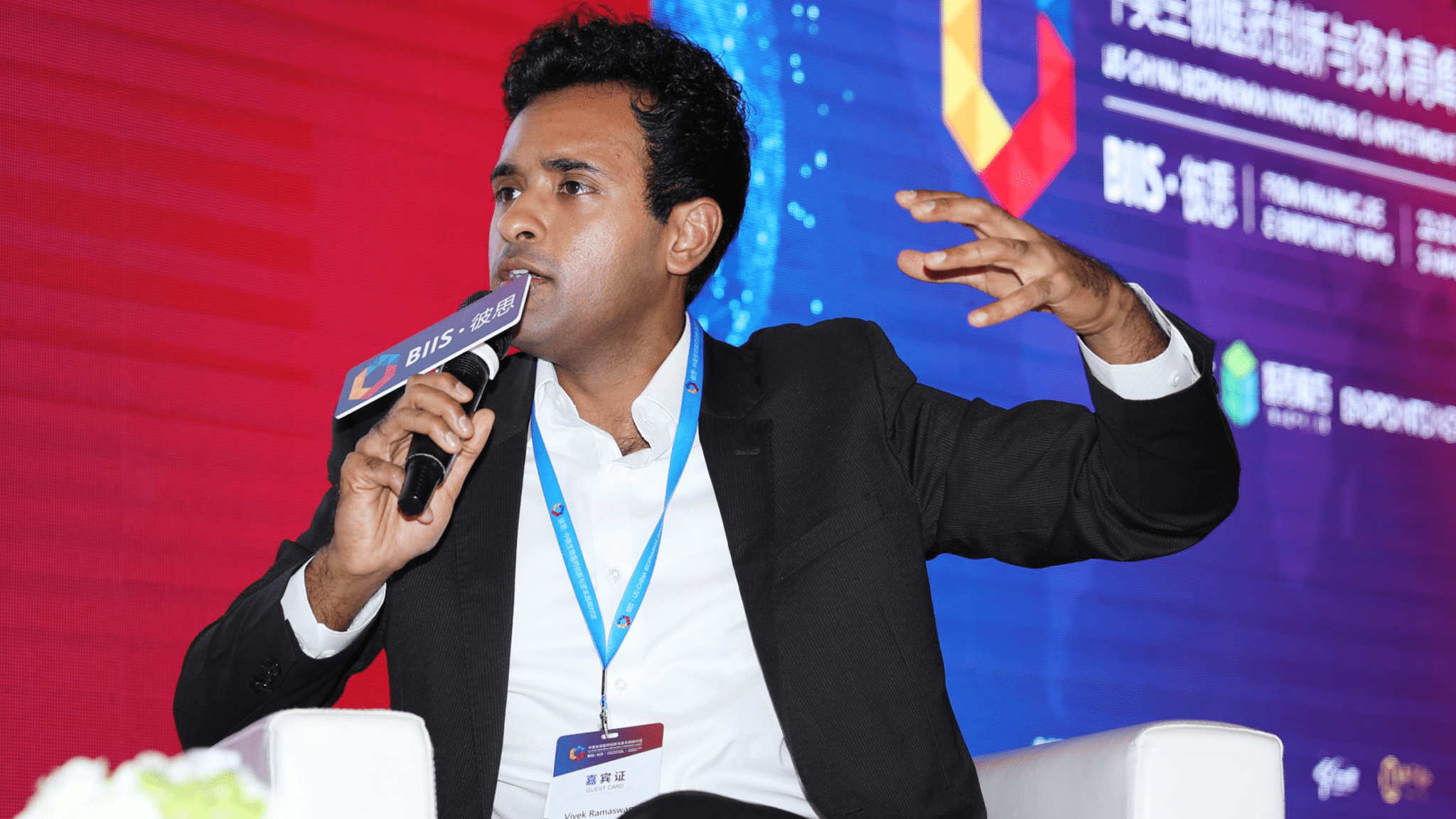

As Roivant’s unicorn valuation swells to $7B, Ramaswamy scoops up $200M to back a new burst of startups

Vivek Ramaswamy never hid his ambitions in swiftly building Roivant into a global biopharma player. But now he’s offering some new details about just how …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.