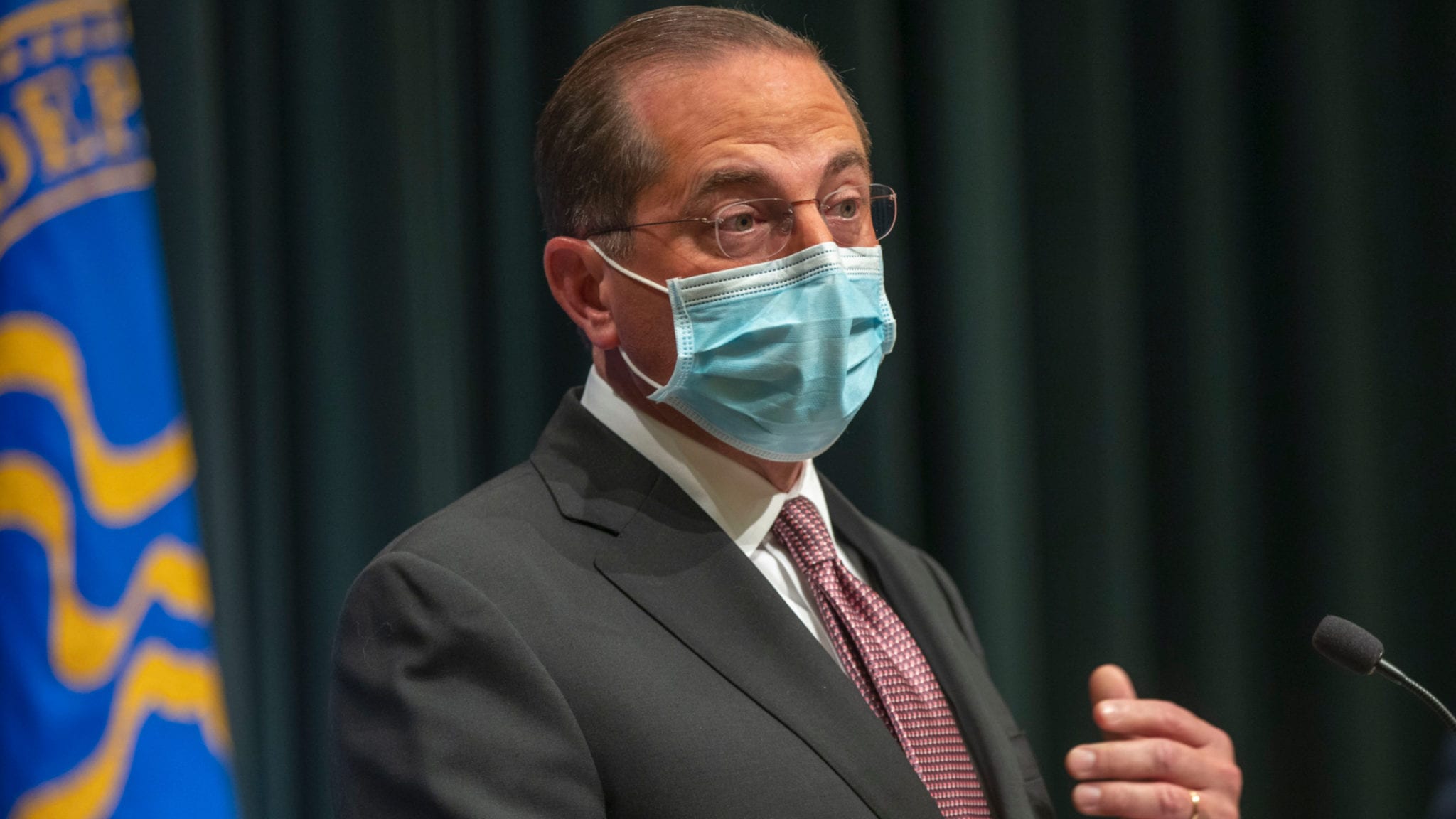

HHS Secretary Alex Azar (AP Images)

Attorneys general ask HHS to punish 340B program bilkers — but pharma claims it's fighting 'waste and abuse'

Imagined as a benefit for low-income patients, the government’s 340B scheme requires participating drugmakers to sell their drugs at significant discounts to play ball in …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.