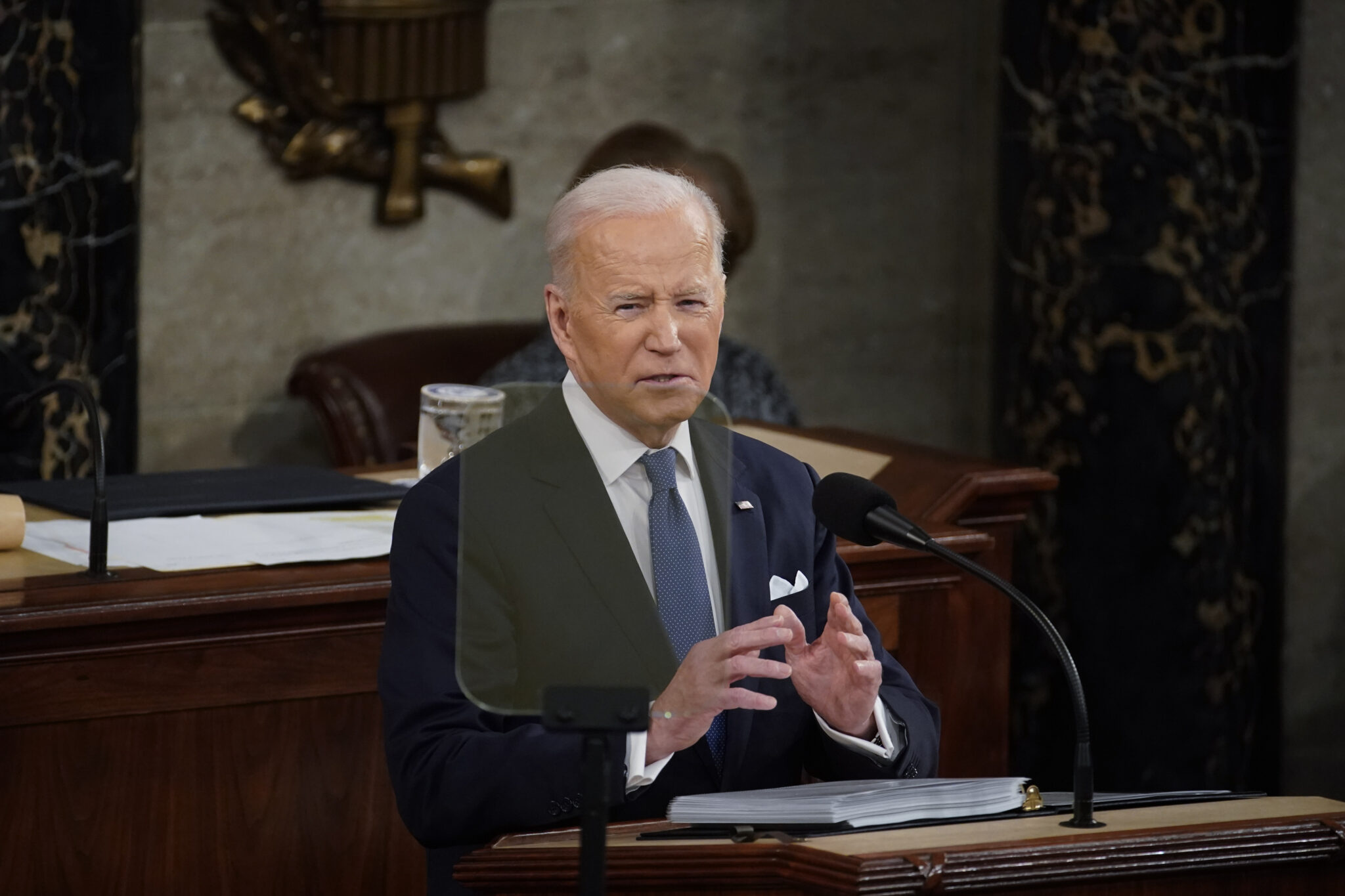

President Biden delivers his State of the Union address on March 1, 2021 (Al Drago, Pool via AP Images)

Biden continues his pledge for Medicare drug price negotiations in State of the Union speech

President Joe Biden is not backing down on advocating for Medicare to negotiate drug prices. In his first State of the Union on Tuesday evening …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.