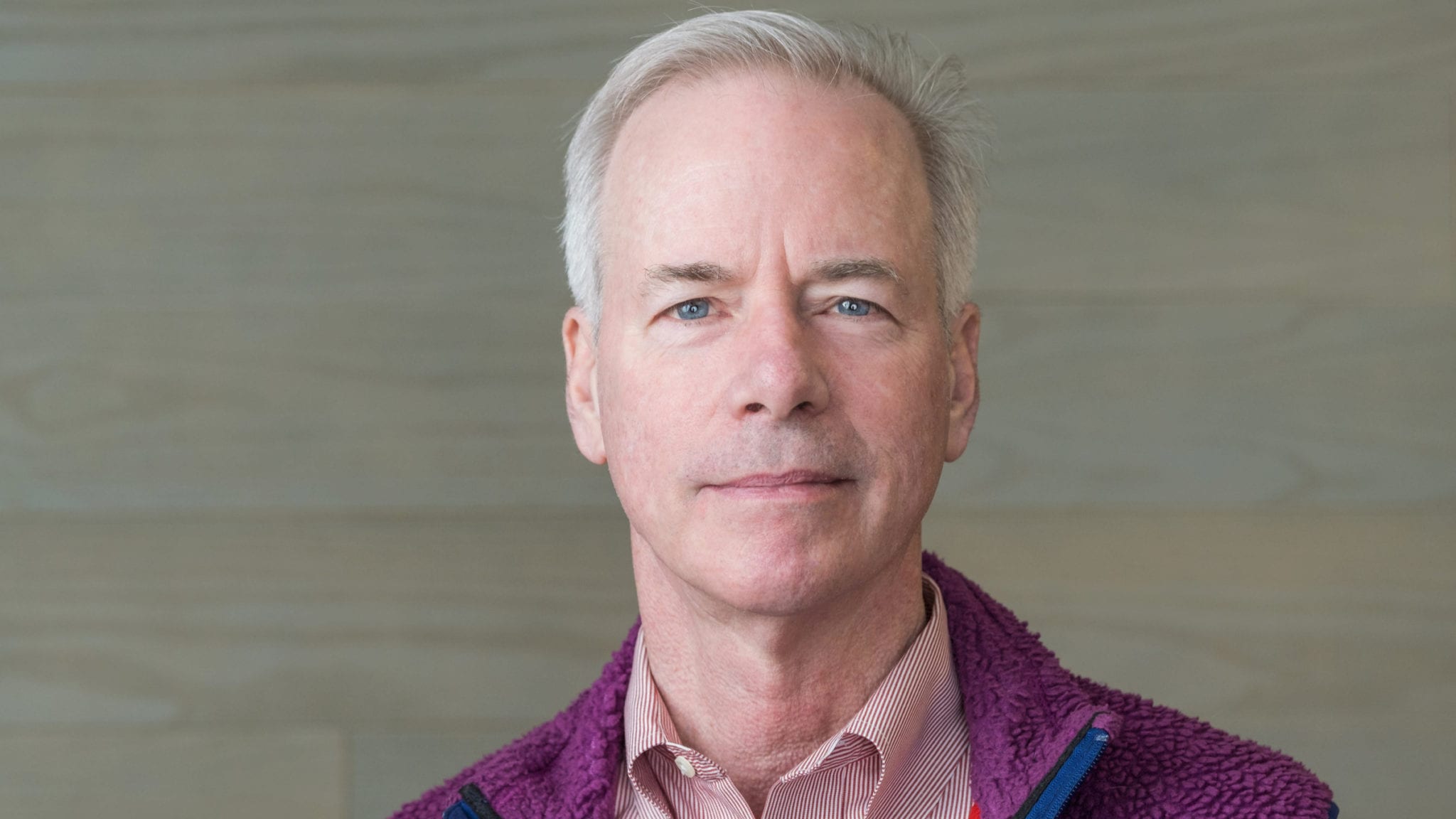

Hugh Rienhoff, Imago

Blood cancer player Imago Biosciences caps off an $80M Series C with an IPO promise for 2021

A little less than two years after securing $40 million in a Series B, Imago Biosciences has returned to the venture capital well with …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.