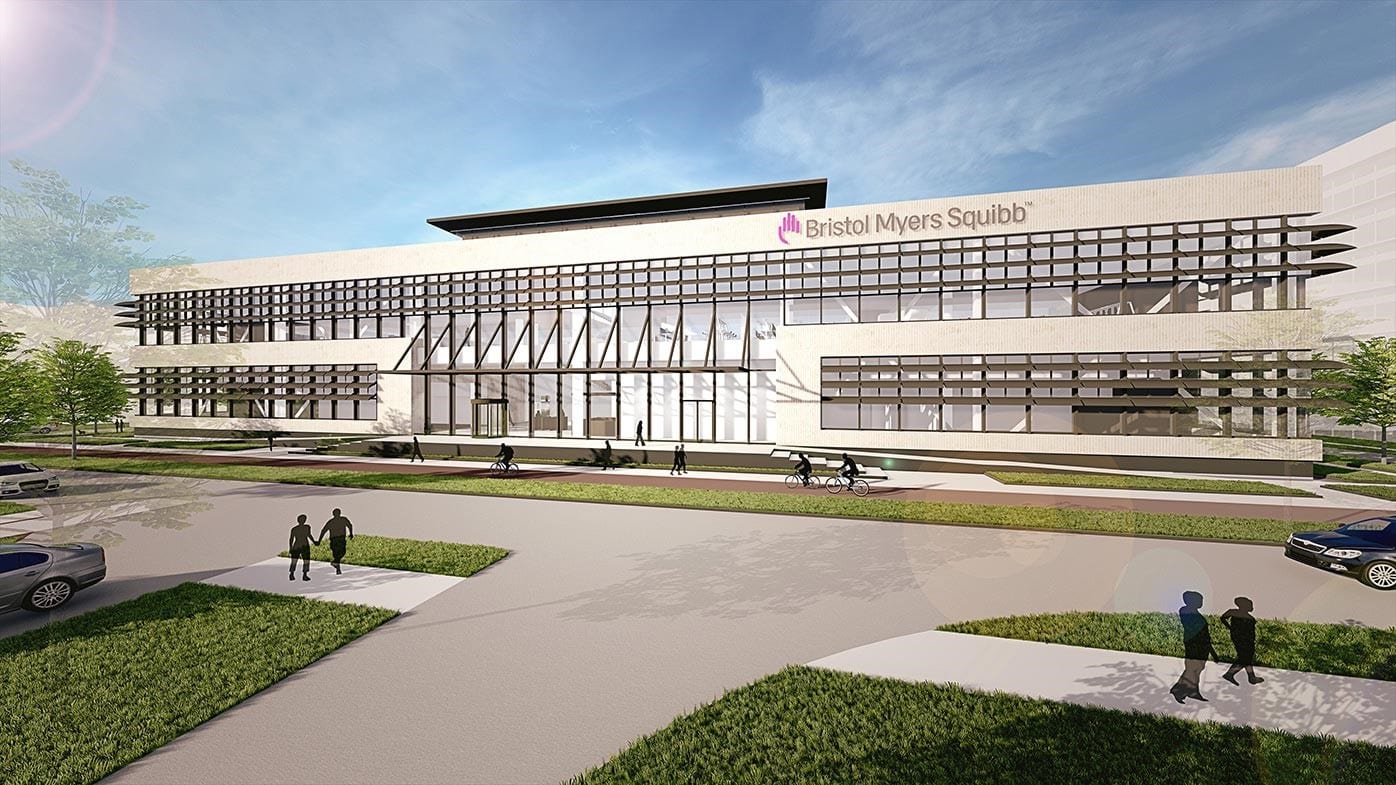

Bristol Myers finds a home for 1st EU cell therapy site, clearing land near Amsterdam airport for easy logistics

As Bristol Myers Squibb continues to scale its CAR-T operations, the New York drug giant will open up its first cell manufacturing site in Europe — and it’s tapped space near the Amsterdam airport as its home.

The company is set to build a new cell therapy site in Leiden and leverage the life sciences community near the airport for convenient access for shipping patient cells. Financial terms were not disclosed.

Unlock this article instantly by becoming a free subscriber.

You’ll get access to free articles each month, plus you can customize what newsletters get delivered to your inbox each week, including breaking news.