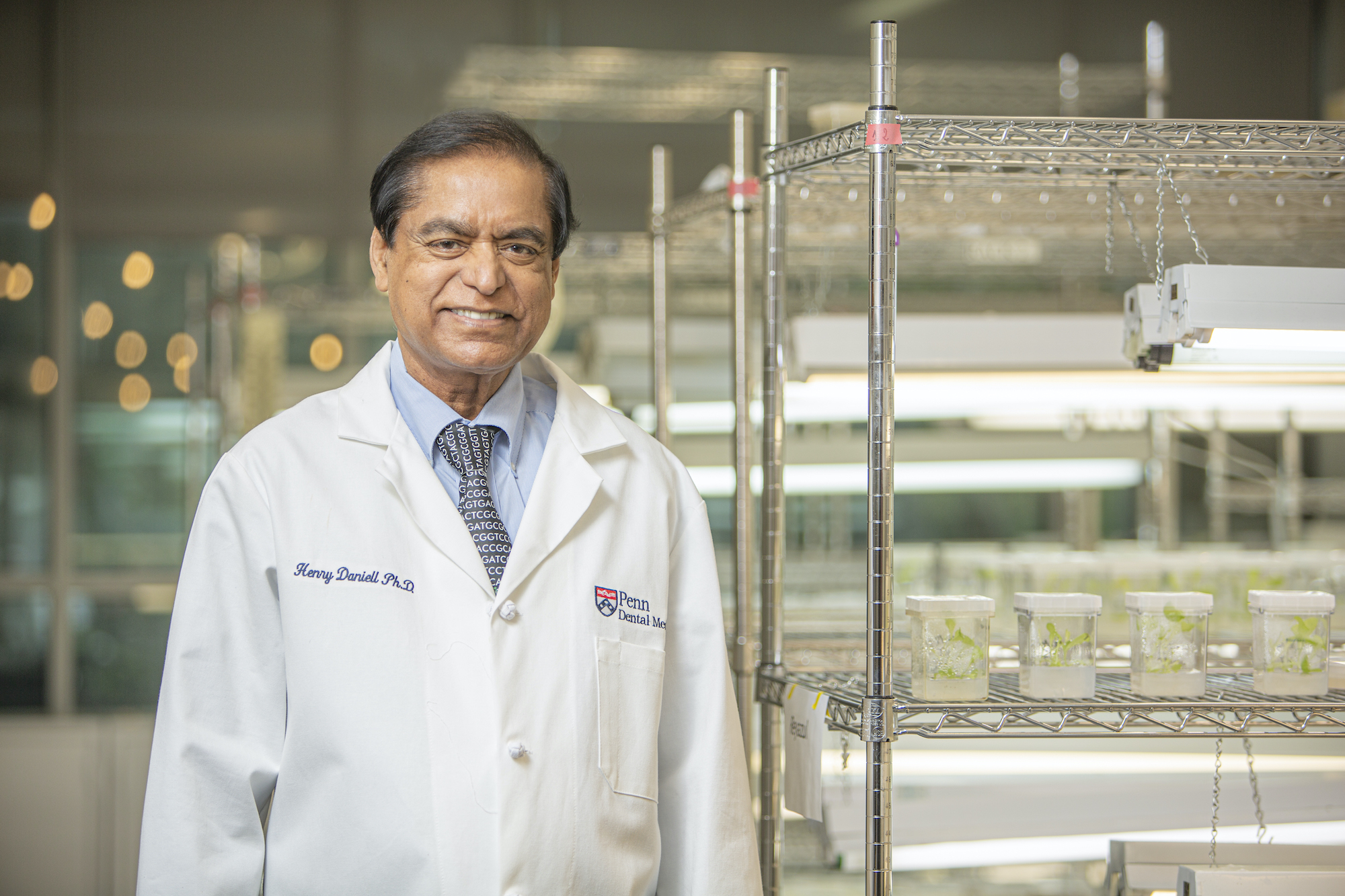

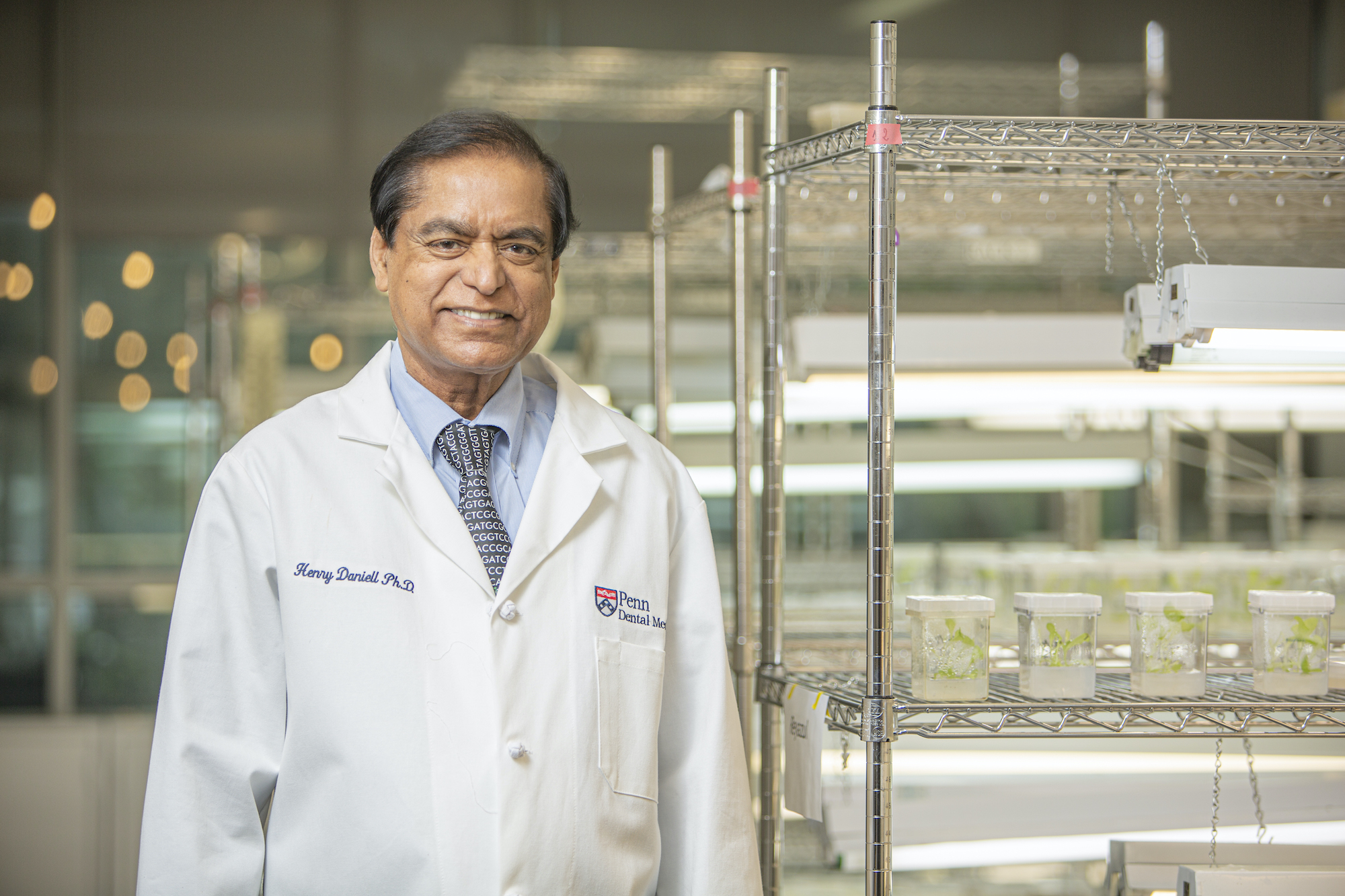

Henry Daniell (Credit: Penn Dental Medicine)

Sign up for free to read a limited number of articles each month.

About YouPick what newsletters get delivered to your inbox each week.

Want unlimited access? Sign up for a premium subscription plan.