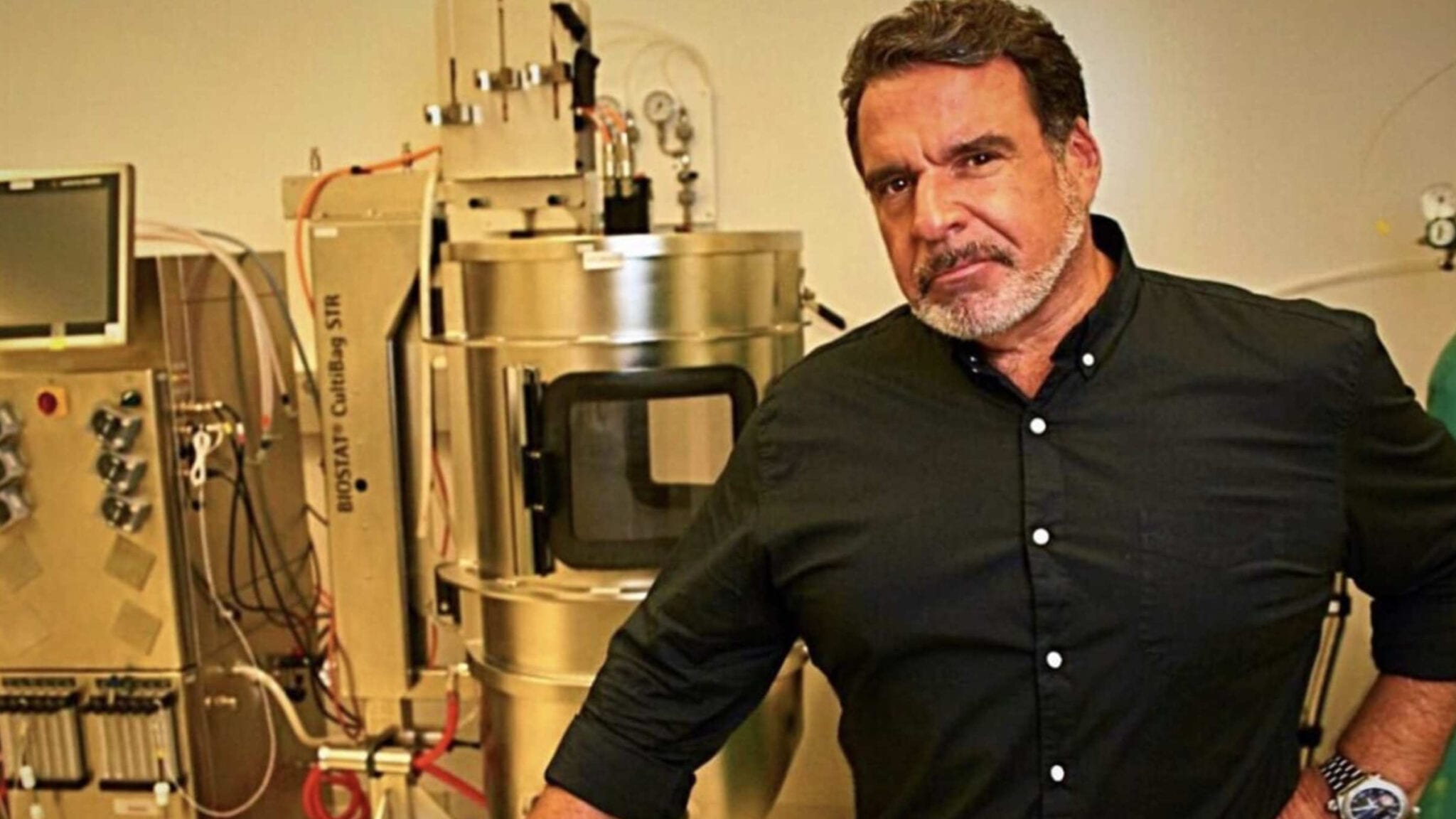

Bob Hariri, Celularity CEO (Celularity)

Celularity emerges from SPAC merger doubled down on cell therapies as Bob Hariri downgrades ill-fated Covid-19 program

It took a few months longer than expected, but Bob Hariri has finally guided Celularity and its placental-derived cells to Wall Street.

Merging with GX …

Sign up to read this article for free.

Get free access to a limited number of articles, plus choose newsletters to get straight to your inbox.